Blog

Almost exactly a year ago, in my last RFID article titled "Keeping Physical Retail In-Stock", I concluded that the two most relevant components of positive customer experiences in physical stores are fast checkouts and products being in-stock. Multiple recent retailer quarterly earnings calls, several articles, and two requests from China on direct consulting with potential investors in RFID inspired this updated technology review.

In the latest Nike earnings call, CEO Mike Parker directly stated that RFID "is improving product visibility and is an important step toward integrating our diverse ecosystem of physical and digital experiences, distribution centers and contract factories." Calvin McDonald, CEO of Lululemon in his earnings call cited the company's strength and unique position in being able "to activate great product across our omni-guest experiences, leveraging our stores, community and events." Both Nike and Lululemon reported strong financial results for their respective quarters.

From what I have personally seen in working with major global retailers deploying RFID, this Internet-of-Things (IoT) technology continues to have digital transformation possibilities.

It's 2019, Are We There Yet RFID?

- Details

How do we Scientifically Change it?

The Loss Prevention Research Council (LPRC) is made up of over 70 retailers (approx. 200,000 stores / $2 Trillion in sales) and 75 solutions partners collaborating to develop effective loss and crime control solutions through science backed extensive research. To date the group has conducted over 300 real world loss prevention research projects for retailers and partners.

Recently, I had the pleasure of attending the launch of "LPRC Innovate" program at the University of Florida. This new working group was stood up to provide cutting edge people, places, processes to support major retailers and solutions partners as they ideate, simulate, and test new digital, people, and design options.

As an industry influencer, it is my pleasure to be joining "LPRC Innovate" as we continue to scientifically re-define and digitally transform the future of retail. To highlight the great LPRC work to date, this article presents a couple never before published examples of what's in the mind of a shoplifter.

Self-Checkout Theft Offender Interview Study

- Details

“Norman (Mayne, CEO of Dorothy Lane Market) is a truly unique merchant. He has a special ability to identify concepts and products that will enthrall customers. Furthermore, he has allowed his people to pursue these same ideals. The result: his stores are masterpieces!” - Danny Wegman, Chairman of Wegmans

In multiple of my articles, I have been consistent that consumers and store associates as brand ambassadors plus immersive customer experiences are the future of retail. Growing up in this industry, it is always exhilarating observing these success elements in a live environment.

Several weeks ago, I had the pleasure of re-visiting one of my favorite stores in the world, Dorothy Lane Market (DLM) in the USA state of Ohio. This retail masterpiece celebrated 70 years of being in business in 2018.

Our quick lunch possibilities visit into one of their locations evolved into an immersive 2+ hour visualization journey of the future supermarket. This post summarizes a few of the captured images and the memories they brought back from previously living in this part of the world.

- Details

Several weeks ago I had the pleasure of participating in a Rethink Retail podcast with Bryan Gildenberg, Chief Knowledge Officer of Retail, Sales & Shopper at WPP’s Kantar Consulting and Paul Lewis, CMO of digital transformation agency Valtech. With Julia Raymond moderating, the three of us debated the growth strategies of Amazon and Walmart in their quest for global retail leadership.

The lively discussions included our musings on Amazon's announcement of one-day shipping, the value of the Amazon's Prime program, potential acquisition strategies for growth, and the looming online grocery battles. This post summarizes additional data insights not discussed in the podcast.

Amazon Strengths

Here's my short list of Amazon strengths that I had summarized in preparing for the podcast:

- Details

In the past twelve months, I have spent substantial quality time with global retailers, expanded my social media reach, engaged a substantial number of technology companies including more Silicon Valley startups; all focused on being a driver of disruptive retail change. Reflecting on what I saw and heard in my just completed European tour this week, I can confirm that retail issues and solutions continue to have global tendencies.

This post will introduce you to what I believe are the top 3 next wave retail growth technologies. These solutions have both security and operational applications, but because I am attending the Retail Industry Leaders Association (RILA) Asset Protection conference starting this weekend, some security aspects will be emphasized.

You Can Run, but You Cannot Hide

- Details

Several data points in recent weeks led to this update on the state of retail self-checkout (SCO) deployments. Among these are the increased self-service stores openings with Asia / North America taking the lead, the evolution from stationary SCOs to multiple variations of Scan & Go applications, and new research, some of which you will only see in this article, on the theft challenges with these new autonomous solutions.

Several data points in recent weeks led to this update on the state of retail self-checkout (SCO) deployments. Among these are the increased self-service stores openings with Asia / North America taking the lead, the evolution from stationary SCOs to multiple variations of Scan & Go applications, and new research, some of which you will only see in this article, on the theft challenges with these new autonomous solutions.

My favorite story was a February 2019 article indicating that Walmart was transitioning from a consumer to a store associate "Check Out With Me" Scan & Go model with shopper theft cited as one of the major reasons. "In one case during the (consumer) Scan & Go rollout, a customer tried to leave a Walmart store with a cart of about 100 items, only 40 of which he had scanned."

Self-Checkout is a Growth Retail Application

According to Greg Buzek at the IHL Group, retailers that have traditional SCO see about 40% of their transactions and 20% of their sales volume now taking place at self-checkout stations. About 20% of large retailers / restaurants are rolling out Scan & Go consumer options in the next 12 months and 44% will have that option through their apps by 2020.

- Details

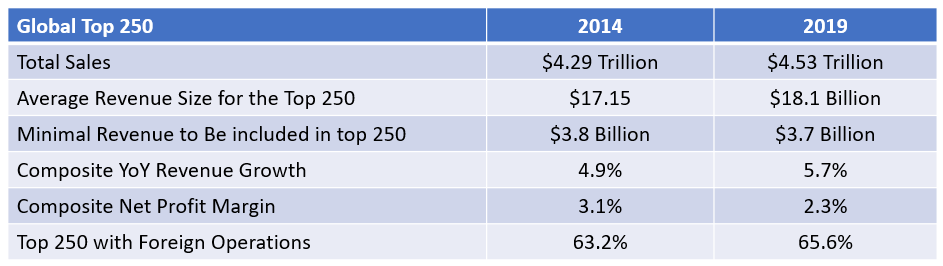

Annually I look forward to the Deloitte Global Powers of Retailing industry research which provides a detailed growth trajectory review of the global top 250 retailers. This year, in addition to summarizing my favorite insights from the 2019 edition, we will look back to the 2014 report to compare and contrast the changes in the retail industry over the last five years.

All the metrics presented in this article are from these two Deloitte industry leading reports. A thought-provoking technology disruption chart from the 2014 report is also included in this post for all of us to assess the retail industry's innovation progress.

The Global Powers of Retailing

The data in the latest report indicates that the global top 250 retailers grew roughly six percent and represented $4.53 trillion in retail revenue.

Note the slight decline in minimal revenue to be included as a top 250 retailer. The industry overall had stronger revenue growth in 2019 versus 2014, but sacrificed margin in the process. Contrary to recent popular presumptions, the percentage of retailers with global operations increased in the latest report.

The Rise of Amazon in the Global Top 10

- Details

Over the last several months I have had the pleasure of spending time with Asset Protection (AP) leaders at Macy's in New York. The visits were sparked by news articles and industry discussions on their advanced deployments of RFID and the smart integration of this Internet-of-Things (IoT) technology into the loss prevention function.

The Retail Benefits of RFID

The primary driver for the deployment of RFID is to improve inventory accuracy. Generically, across the retail industry, "RFID enables cycle counts to be completed about 25 times faster than traditional manual bar code scanning. Frequent, accurate cycle counts improve inventory accuracy, typically by 20 to 30 percent, allowing a number of retailers to achieve 99 percent inventory accuracy. This enables replenishment alerts to be reliably generated, increasing on-floor availability, and decreasing out-of-stocks (OOS), typically by 15 to 30 percent. This in turn results in sales uplift in the range of 1 to 10 percent or more for those categories."

While inventory visibility is the number one benefit of RFID, in multiple industry studies, loss prevention is always near the top as a primary application. Here is an example from the 2018 Technology Outlook in the Apparel Market research.

- Details

Each Saturday just prior to the January NRF Big Show, retailers, industry analysts and solutions providers gather in New York City for a unique IT conference. This fast-paced full day is a special blend of emotionally filled stories of the RetailROI (Retail Orphan Initiative) global charity work and the latest insights on the state of the retail industry.

From this year's SuperSaturday edition, here is a summary of the altruistic work of RetailROI, the latest research on the 2019 essential retail technologies, and an inspirational close on the power of branding transformation.

A RetailROI Difference

- Details

38,000+ Attendees, 16,000+ Retailers, 800+ Exhibitors, 100+ Sessions, 99 Countries

Let me open by sharing the video summary provided by the USA National Retail Federation (NRF) of this year's edition.

This entire week, over all my social media platforms, I am publishing multiple other NRF 2019 summary reviews. Primarily from an Expo floor perspective where billions of innovation dollars are being invested, here are my impactful retail transformational takeaways.

IoT is not Just a Buzzword

NRF 2019 confirmed that the Internet-of-Things (IoT) is moving from a buzzword to solving industry problems. Solutions were visible all over the Expo floor.

- Details