Several data points in recent weeks led to this update on the state of retail self-checkout (SCO) deployments. Among these are the increased self-service stores openings with Asia / North America taking the lead, the evolution from stationary SCOs to multiple variations of Scan & Go applications, and new research, some of which you will only see in this article, on the theft challenges with these new autonomous solutions.

Several data points in recent weeks led to this update on the state of retail self-checkout (SCO) deployments. Among these are the increased self-service stores openings with Asia / North America taking the lead, the evolution from stationary SCOs to multiple variations of Scan & Go applications, and new research, some of which you will only see in this article, on the theft challenges with these new autonomous solutions.

My favorite story was a February 2019 article indicating that Walmart was transitioning from a consumer to a store associate "Check Out With Me" Scan & Go model with shopper theft cited as one of the major reasons. "In one case during the (consumer) Scan & Go rollout, a customer tried to leave a Walmart store with a cart of about 100 items, only 40 of which he had scanned."

Self-Checkout is a Growth Retail Application

According to Greg Buzek at the IHL Group, retailers that have traditional SCO see about 40% of their transactions and 20% of their sales volume now taking place at self-checkout stations. About 20% of large retailers / restaurants are rolling out Scan & Go consumer options in the next 12 months and 44% will have that option through their apps by 2020.

The SCO market is expected to exceed more than US$ 5 billion by 2024 at a CAGR of 10.3% in the forecast period. Sample North America retail chains either deploying or piloting the Scan & Go variation include Kroger, Dollar General, and 7-Eleven.

With 10 stores opened so far, the Amazon Go self-service store model could be a $4 billion business for the company by 2021. Over 500 Bingo Box self-service locations are already open in China.

The Categories and the Generation Gap

Forty-eight percent of USA internet users believe that Scan & Go technology would make shopping easier and 43% would rather try Scan & Go than wait in a checkout line. Favorite categories are groceries, home goods, and fashion items.

Sixty percent of internet users worldwide would prefer to shop at other retailers, if they offered an Amazon Go-like experience. Not surprisingly in this digitally connected era, this jumps to 77% for consumers aged 18-34.

The Retail Self-Checkout Challenge

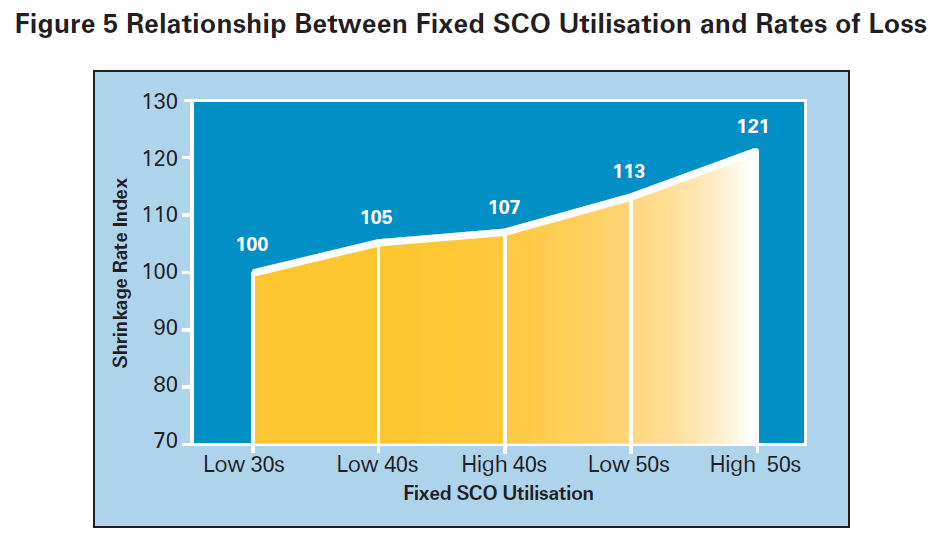

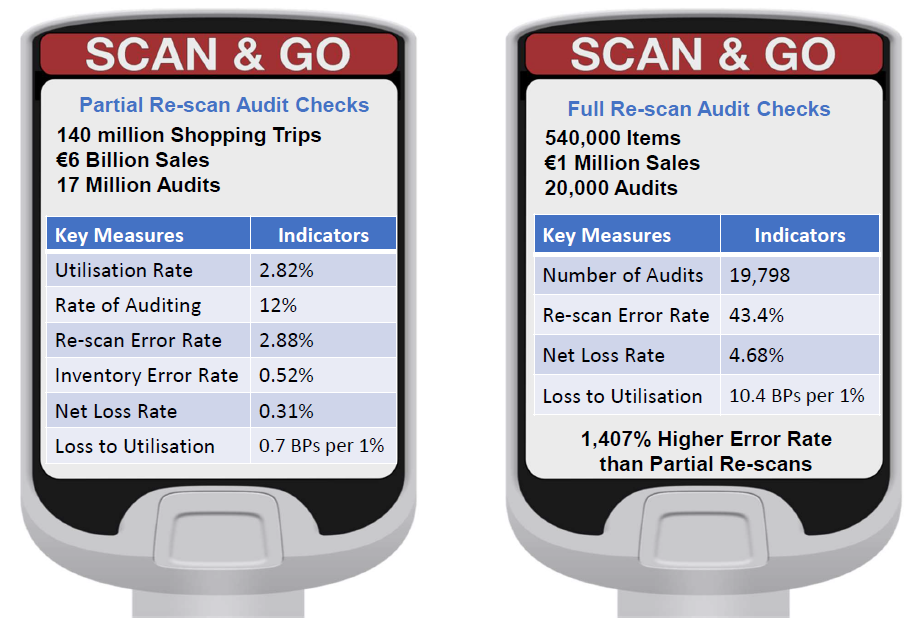

Late last year the Europe-based ECR Group published an extensive study quantifying the risk associated with self-checkout. Among the key findings:

- Data comparing stores with and without Fixed SCO found that levels of loss were higher in the former than the latter, with some grocery case studies recording losses in the region of 33% to 147% higher.

- Stores where 55-60% of transactions went through Fixed SCO can expect their shrinkage losses to be 31% higher.

- For a store with 50% of transactions being processed through Fixed SCO, it can expect its shrinkage losses to be 75% higher than the average rate found in grocery retailing

- Stores using Scan & Go technology could see overall losses in the region of 0.96% of sales – a 43% increase.

The ECR report concludes that the data was not clear in its theft conclusions. There are many who assert based on their experiences that the losses are more likely to be mistakes and errors. Valuable guidance is provided on a framework featuring 11 themes that retailers can implement to manage the associated risks with the use of SCO technologies.

The ECR report concludes that the data was not clear in its theft conclusions. There are many who assert based on their experiences that the losses are more likely to be mistakes and errors. Valuable guidance is provided on a framework featuring 11 themes that retailers can implement to manage the associated risks with the use of SCO technologies.

Why Is Self-Checkout a Theft Target?

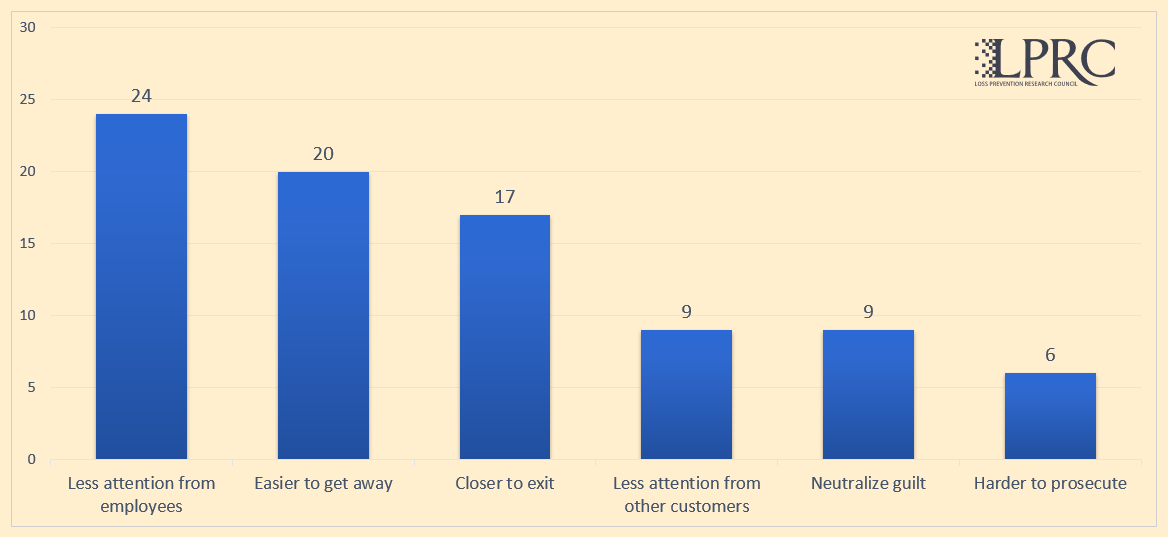

The USA-based Loss Prevention Research Councils (LPRC) asked actual shoplifters “Why would you use self-checkouts to commit theft?” Exclusive to this article here is what is the mind of a shoplifter:

The Loss Prevention (LP) Cxx Moment

As the data clearly indicates, SCO is a major growing retail application. From speaking to multiple global retailers, it is in fact a core element of their future innovation roadmap that meets the "must have" of new digitally empowered generations.

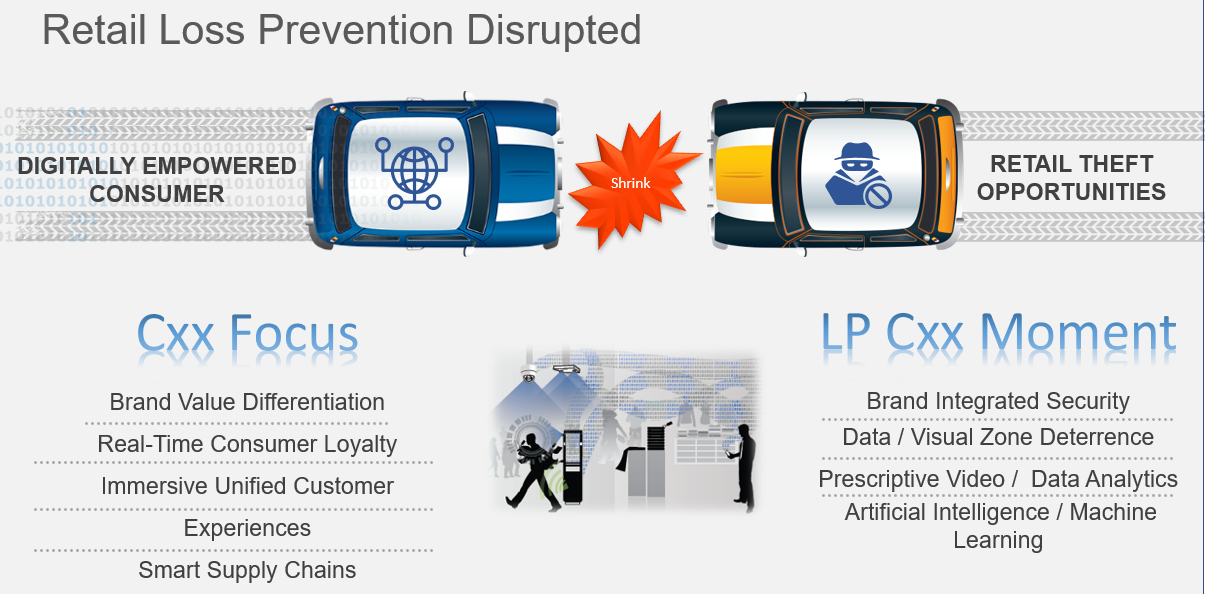

In my globally delivered "The Disruptive Future of Retail" keynote presentation, I share this chart where I elaborate that this autonomous transition is a major opportunity to evolve the retail industry.

Digital transformation trends are leading to a collision between a technology empowered consumer and increased theft opportunities. For Loss Prevention, the SCO challenge is one of those unique Cxx moments to evolve to differentiated strategies / technologies that securely enhance the value of the retail brand.

The solutions to the SCO deployment risks are more intensive consumer / associate engagement for proper utilization and a new set of strategies / emerging technologies focused on frictionless consumer experiences.