Retail

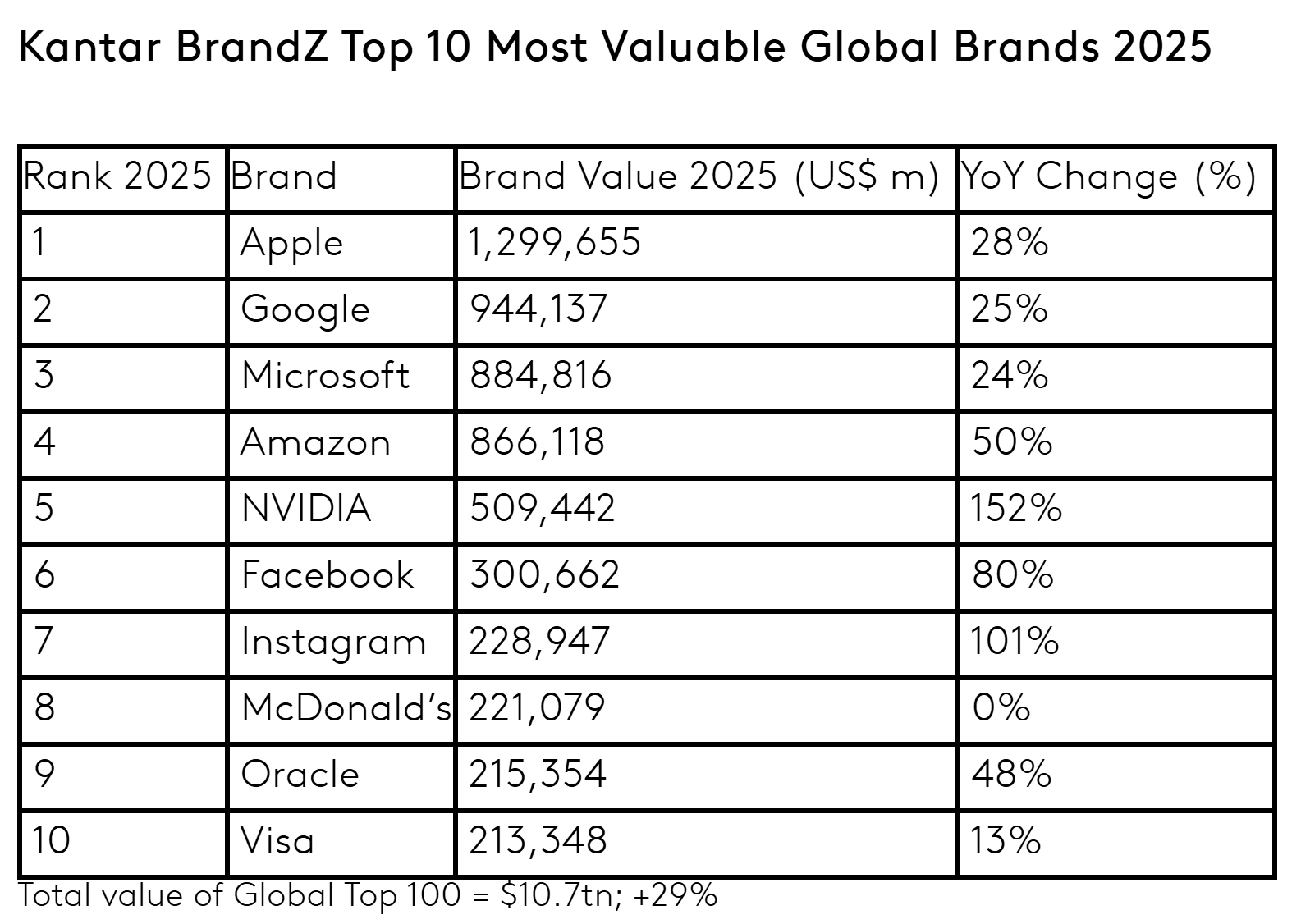

The new Kantar BrandZ leadership branding report has arrived and it is time to summarize my favorite content and categories. The 20th edition of this research finds that since 2006, over $9.3 trillion has been added to the Global Top 100, now valued at $10.7 trillion.

Brands from the United States, "now comprise 82% of the total value of the Global Top 100, up from 63% in 2006, but a rise among Chinese brands and volatility caused by escalating tariffs could threaten this order. Chinese brands have doubled their value over the past 20 years, now accounting for 6% of the overall value of the Global Top 100. These shifts have come at the expense of European brands, which for now account for only 7% of the Global Top 100 (down from 26% in 2006)."

"Even through economic crises, the world’s most valuable brands have consistently outperformed the S&P 500 and MSCI World Index over 20 years. This is irrefutable proof of marketing’s value. A brand is a company’s most valuable asset, and the last thing businesses should be doing in response to market shocks is cutting marketing investment."

"Brands that disrupted their category or reinvented themselves have accounted for almost three-quarters (71%) of the incremental $9.3 trillion of value created in the Global Top 100 since 2006. In 2025 this includes Stripe and Chipotle, which have entered the ranking for the first time (in 85th and 86th place) and Aldi, which has been in the Global Top 100 for 15 of the past 20 years, and is currently ranked 94th."

This article focuses on the global branding leaders in apparel, luxury and retail. All content is from the 2025 Kantar BrandZ Report including ideas on on avoiding brand failures, insights to branding leadership, and a peek at AI future impact.

Brand Failure is NOT an Option

- Details

With trade barriers rising, it is time to look deeper on the impact for both consumers and the retail industry. China with a 145% rate is the outlier country to the temporary 90 day pause to reciprocal tariffs recently announced by the United States.

The result as reported by the Wall Street Journal is that shipping bookings of out China have dropped by 60% this past week. According to Greg Buzek from IHL Services, so far, 90 container ships have been cancelled which is 80% more than when China shut down from COVID in May of 2020. As he elaborates, each ship carries the equivalent of 3 USA malls worth of products with the expected pain to be felt in stores in the June timeframe.

China represented 11% of all U.S. trade in 2024, with electronics, machinery, toys, sports equipment and furniture making up more than half of all imports. For consumers related products, China manufactures 73% of toys, 22% of apparel, 36% of footwear, 28% of cutlery, 22% of leather goods, 29% of glassware, 31% of ceramic products, 41% of printed materials such as books, 93% of umbrellas, 36% of musical instruments, 26% of silk / yarn, 35% of vegetables not fully prepared, 77% of chalk, and much more.

Most retailers have been working to mitigate exposure to China. In terms of cost of goods sold, 20% of Target's, 15% of Walmart, 60% of Five Below, 32% of Dollar Tree, 25% of Home Depot, 20% of Lowe's, 55% of Best Buy's, and 25% of Dick's Sporting Goods originate in China. The full exposure is difficult to measure as some Chinese products are shipped to other countries as raw materials where they are turned into finished goods for export to the United States.

Primarily from a consumer point of view, this article delves into the impact of tariffs for the retail industry. How concerned are consumers? How are they responding? Which retail categories have the highest impact? What products will face cutbacks? How do different countries perceive tariffs? How should retailers respond?

Tariffs Adding to Consumer Stress

- Details

Retail violence is becoming an alarming trend across Australia, the United Kingdom, and the United States, posing significant challenges for businesses, employees, and consumers alike. Reports indicate a sharp rise in incidents ranging from verbal abuse and shoplifting-related aggression to physical assaults on retail staff. This escalation is driven by multiple factors, including economic pressures, organized retail crime, and shifting societal attitudes toward theft and confrontation.

These trends were confirmed at the Sydney Retail Risk Conference after my "Disruptive Future of Retail" keynote delivery. The opening picture of this post is from that retailer engaging session. This is actually the exact moment in the presentation where I was describing to the Australian audience the retail violence trends in the United States and United Kingdom. The subsequent discussions with the local retailers inspired this new blog.

For consumers, the surge in retail violence has far-reaching consequences. Increased security measures, staff shortages due to safety concerns, and higher operational costs often translate to longer wait times, restricted store access, and rising prices. Moreover, the growing unpredictability of retail environments erodes shoppers' sense of safety, discouraging in-person visits and reshaping the retail landscape.

This article explores the trends behind rising retail violence in these three nations, examining the technology preferences in each of the countries. It concludes with some of my own thoughts on how we solve these growing and alarming retail crime problems.

Australia Retail Crime Up 40% Over Last Two Years

- Details

The retail industry is undergoing a seismic transformation, driven by a confluence of forces reshaping the way businesses operate and consumers shop. From the rapid consolidation of major players to the disruptive impact of e-commerce and emerging technologies, the sector is in a state of flux. At the same time, retailers are grappling with rising security concerns, as organized retail theft and shrinkage reach unprecedented levels.

As companies race to adapt, they face a delicate balancing act—investing in cutting-edge technology to enhance customer experiences and operational efficiency while addressing the financial and logistical challenges posed by theft and competition. Artificial intelligence, automation, and data analytics are emerging as critical tools, but will they be enough to safeguard profitability and sustainability in an increasingly volatile market?

The last few weeks have been filled with meetings with many global retailers across multiple continents. Cultures may be different, but the formula to delight and engage consumers with differentiated branding strategies is similar across the world.

Part of this latest global retail inspirational journey includes delivering my keynote on "The Disruptive Future of Retail." This article summarizes some of my favorite new insights on the changing retail landscape, retail concentration & disruption, technology priorities, and the opposing retail theft innovation forces.

The Ever-Changing Retail Landscape

- Details

"2025 will be the year where science fiction becomes a shopping reality. From AI-enabled hyper-personalized experiences to the rise of responsive ads via retail media networks to next-gen supply chain automation, the retail industry is transforming on all fronts." - Capgemini

What an exhausting, exciting, inspiring, highly motivating week in New York on the annual pilgrimage to the National Retail Federation retail Big Show to experience the future of retail. For the week, logged nearly 100,000 steps or 42 miles (67.5 Km) in visiting stores, engaging retailers, walking the show floor, meeting analysts, and showcasing new innovations for Sensormatic.

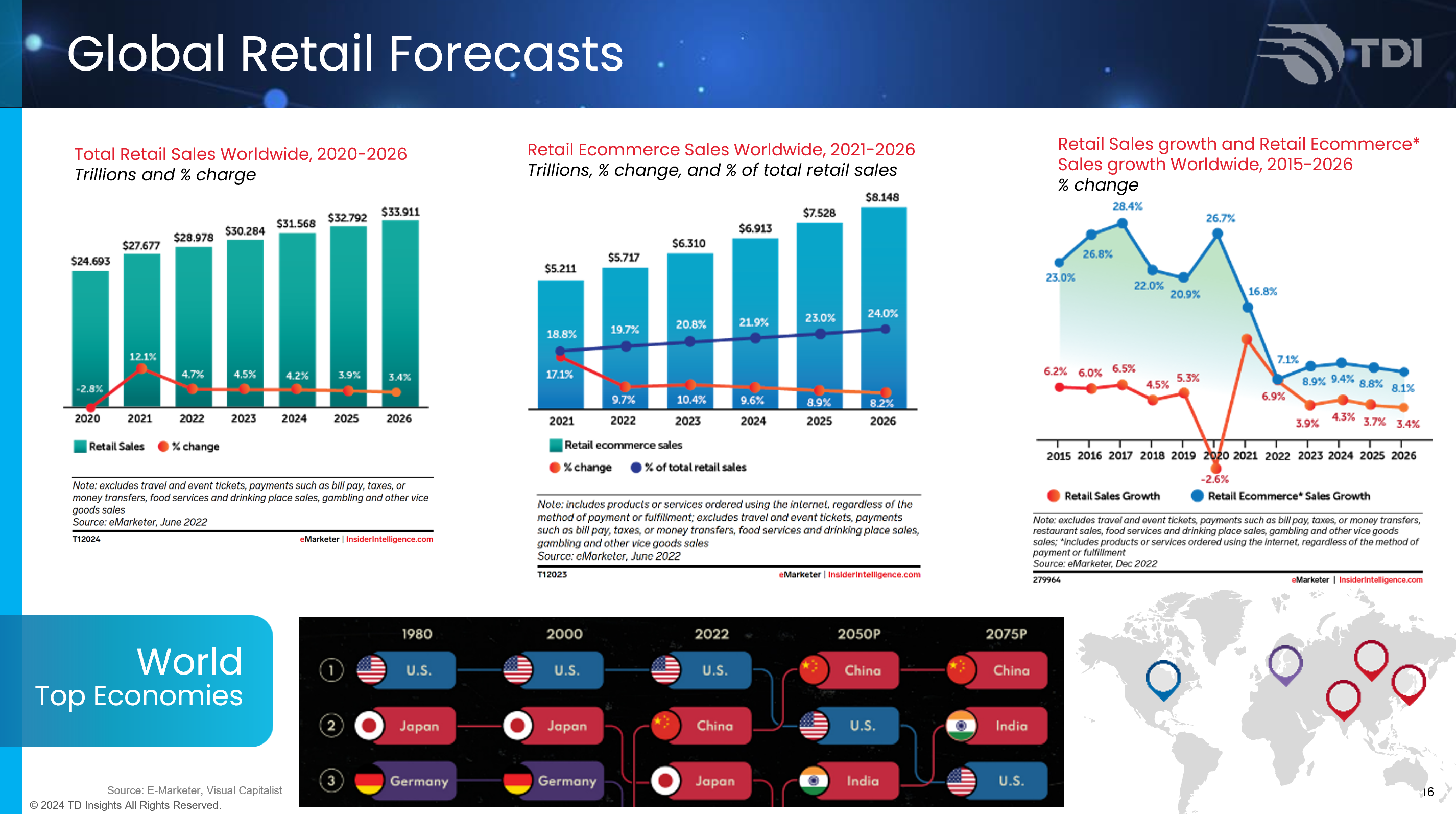

On stage in a Sensormatic sponsored event with the retailer PVH, in my opening comments, I congratulated the audience for working in one of the most vibrant industries in the world. In 2025, the global retail industry will reach nearly $33 trillion, growing at roughly 4% per year through 2026.

By 2026, 76% of total global retail sales will still be physical stores. The growth gap for online sales and stores is narrowing. Growing middle classes in large economies and emerging countries will keep the industry thriving for many years to the come.

This article summarizes my top 5 data supported takeaways from the 2025 edition of the Retail Big Show. One of these trends offers a counter view that needs to be addressed to keep the retail industry positively moving forward. All the quotes cited in this article are directly from attendees or from articles published the same week.

Where Tech and Tears Meet

- Details

In a year where consumers still fretted about inflation, Santa Claus delivered a solid holiday shopping season. According to a Mastercard Spending Pulse report, total spending this holiday season increased 3.8% over 2023, surpassing the previously forecasted rise of 3.2% and beating last year's increase of 3.1%. For the shopping period between November 1 to December 24, online grew 6.7% while in-store sales grew 2.9%.

On some levels, 2024 was a challenging year for the USA retail industry. According to Coresight, through November 2024, retailers were projected to close over 7,100 stores, a 69% increase over the same period in 2023. Somewhat surprisingly, the top 5 retail chains with the highest number of physical stores closures were Family Dollar, CVS Health, Big Lots, Conn's, and Rue21.

The mixed results fulfill the prophecy by the Economic Intelligence Unit which in 2024 forecast offline retail as cloudy, online retail as stormy, food as cloudy, and non-food also stormy. In December 2024, three other major chains announced either bankruptcy proceedings or liquidation sales: The Container Store, Big Lots, and Party City.

Is another retail apocalypse for physical stores in the 2025 retail horizon? What are the latest growth forecasts for global retail in 2025? What are the top 5 disruptive retail predictions for 2025?

The 2025 Global Retail Forecasts

- Details

Today's world is media noisy, but much of the messaging is broadly delivered with minimal impact. Television and newspapers were primary historical mediums for delivering product knowledge, differentiation, and building consumer loyalty.

The average human attention span has dropped from 12 seconds in 2000 to a just 8 seconds in 2020. A goldfish now has a higher span that a human at 9 seconds.

The internet has intensified the media noise. Globally, individuals between the age of 16 to 64 now spend an average six hours, 40 minutes online (for the United States is 7 hours and 3 minutes). This equates to 47 hours per week and 101 days per year. By this estimation, beginning at age 18, a person who lives to 80 will have spent 17 years of their adult life using the internet.

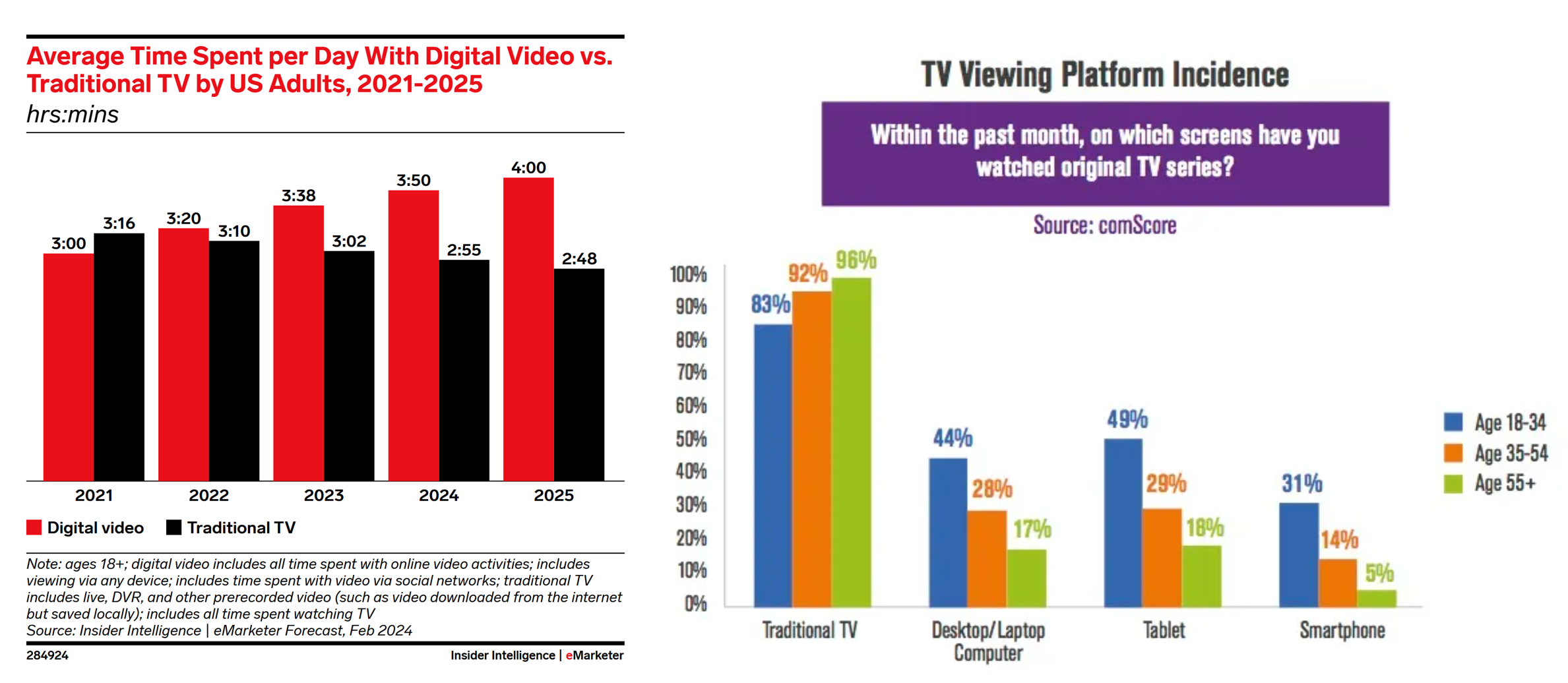

The increased online digital noise is changing viewer habits of traditional media such as television. Note the decline in daily viewing time with digital surpassing traditional television in 2022.

Younger generations are accelerating the shift to digital. About 1 out of 6 Millennials said they did not watch any original TV series from traditional TV sets within the past 30 days, a significant trend highlighting the potential for linear TV viewing to erode over time. If young people do watch television, it is on other digital devices, often skipping the commercials.

In the 1970's, the average person was exposed to 500 to 1,600 ads per day. The changes in media consumption including the proliferation of digital devices, growth of social media, programmatic advertising, and content distribution have dramatically elevated the ad numbers 4,000 to 10,000 per day.

Focusing on the retail industry, how does one break through all this digital noise and deliver effective content? Where is the best place to increase attention spans for targeted ads for the consumer? What is the profitable future of retail media networks?

The Retail Media Networks Opportunity

- Details

It is beginning to look a lot like Christmas, everywhere you go. With decorations now appearing in stores as early as August, reminders are everywhere on the continued importance of each holiday shopping season.

Some statistics on the importance of retail, the holiday season,and the impact on the overall USA economy:

Roughly 70% of U.S. gross domestic product (GDP) is generated by consumer spending. Holiday sales in the months of November and December have averaged 19% of total annual retail sales over the last five years. In 2023, USA retailers hired between 345,000 to 450,000 holiday seasonal workers. 75% of retail small businesses rely heavily on holiday sales to meet their annual revenue goals.It is time to summarize multiple of my favorite retail holiday forecasts For 2024, most of these project lower historical retail sales growth, even as the September's job report continued to deliver positive economic surprises.

Global Consumers Are Feeling the Pinch

- Details

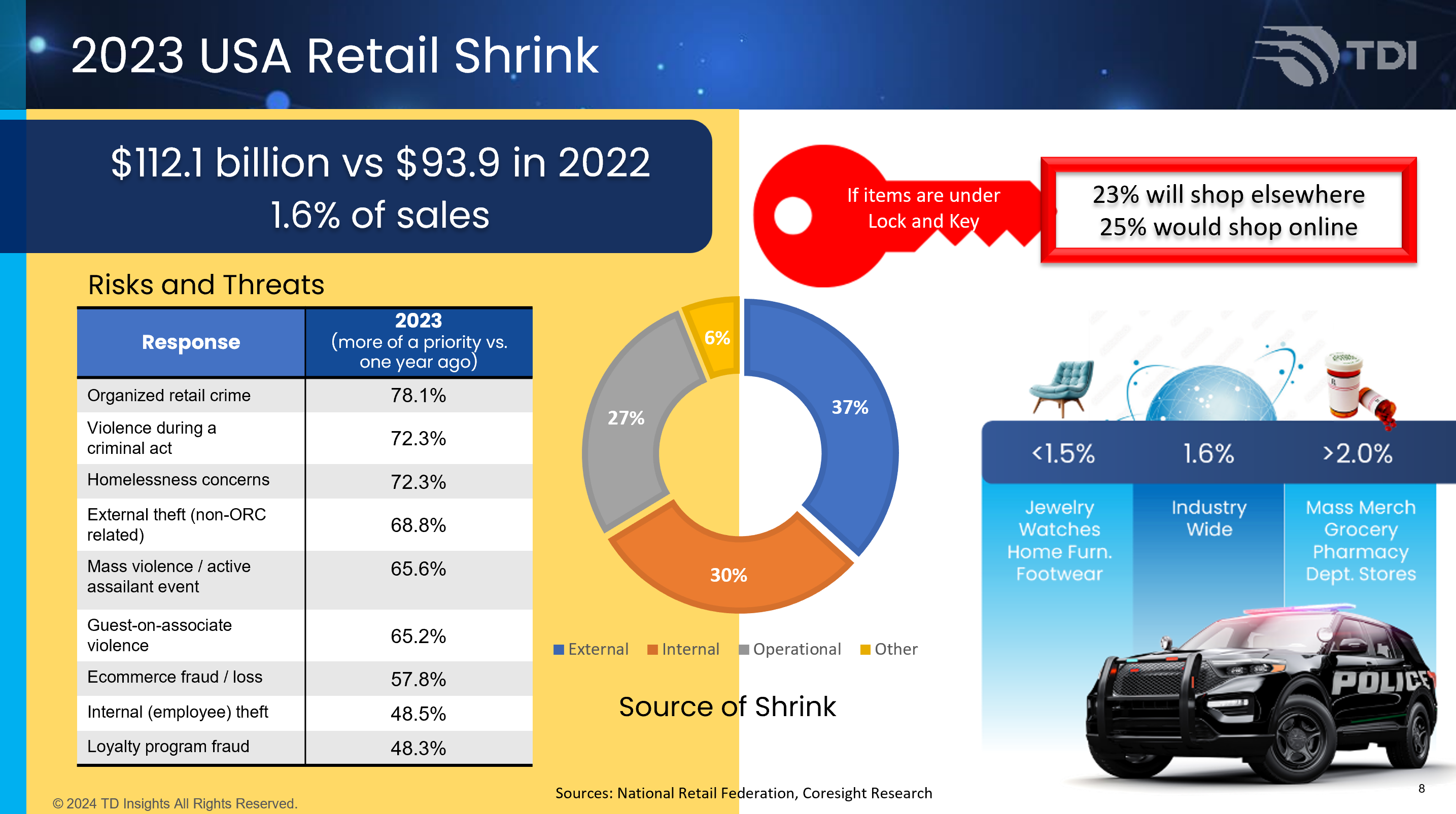

In the latest USA National Retail Federation Security Survey published in September 2023, retail shrink increased from 1.6% of sales from 1.4% in the previous year. This equates to $112.1 billion in losses, up from $93.9 in the previous year. The top 3 retailer priorities in the new NRF survey versus the previous year were organized retail crime (78.1%), violence during a criminal act (72.3%), and homelessness concerns (72.3%).

What's changed since the 2023 NRF security survey was published? How does theft impact inventory distortion? What are the latest shoplifting trends? How do consumers respond to retail theft? Why is retail crime at a crisis point? How does USA compare to other countries with this problem? How do we solve the problem of retail shrink?

The $1.7 Trillion Dollar Global Retail Problem

- Details

Digital retail transformation continues to be on my mind. This follows increased engagement with retailers on multiple continents and observing how they are embracing technology to create immersive experiences that drive more profitable operational efficiencies. From their lessons, the questions that I continue to contemplate include:

Will the future of retail be phygital or omnichannel? How will current trends from next generation shoppers such as Gen Z change retail in the next 10 years? What emerging technologies must make progress to deliver a more profitable future of retail?The Retail Boss nicely summarized the key differences between phygital and omnichannel retail strategies. "Phygital and omnichannel strategies both aim to enhance customer experiences but differ in their approaches. Phygital focuses on merging physical and digital worlds to create immersive, personalized experiences, often leveraging technologies like QR codes and augmented reality. On the other hand, omnichannel integrates various communication channels to provide a seamless and consistent brand experience across all touchpoints, such as physical stores, websites, and mobile apps. While phygital emphasizes the fusion of online and offline interactions, omnichannel prioritizes a unified customer journey across multiple platforms."

As Morningstar reported, "Generation Z, the first truly digital-native cohort, is rewriting the rules of engagement in the retail sector with their preferences and behaviors. Born into a world where the internet, smartphones, and social media are ubiquitous, zoomers' influence is shifting the retail paradigm from predominantly in-store interactions to a complex, integrated model that blends online and offline experiences seamlessly. Their comfort with technology and demand for instant, on-demand access to products and services are driving retailers to reimagine how they connect with consumers."

Technology will continue to disrupt retail business models. The industry's future requires increased digital strategies to turn consumers into brand ambassadors. Concurrently, the entire retail ecosystem and especially the physical store, must increase its digital stickiness through tech empowered store associates as equal brand ambassadors.

Future Consumers Technology Preferences

- Details