Throughout my retail career, I have closely followed the growth and progress of the grocery sector. Partially this is the result of actually having worked in a supermarket for 9+ years across many departments.

The importance of this retail segment is reinforced by Deloitte in their annual 'Global Powers of Retailing Report'. The 2020 edition found that fast moving consumer goods (FMCG) which includes grocery, drug, mass merchants, and convenience represents 66.5% of the total retail sales for the global top 250 retailers. Also interesting from that research, this sector tends to least globalize operations and recorded in 2020 the lowest composite net profit margin at 2% of sales.

The pandemic has become a brutal accelerator of digital transformation trends for all retail and grocery has not been immune from the disruption. Being classified as an essential business was a tremendous advantage for food, drug, convenience, and mass merchandise retailers. During the lockdowns, nearly $300 billion in wealth was transferred from general merchandise / hospitality to FMCG retailers.

As I stated in a recent Rethink Retail podcast, grocery sales which were only up 3% in 2019, jumped 11.5% in 2020. The sector stayed financially positive throughout the pandemic and still has substantial opportunities for additional growth. This podcast, recent grocery news from Amazon, and new research inspired this article.

Walmart versus Amazon: The Grocery Wars are Just Getting Started

In 2020, grocery accounted for 56% of Walmart total sales in the United States. The recently announced FY 2021 Walmart earnings results confirmed the substantial value of brick-and-mortar physical stores as USA comparable sales increased 9% while concurrently online sales rose an amazing 69%.

Walmart was deploying advanced Buy-on-line-Pick-Up-in-Store (BOPIS) models well ahead of COVID-19. This included substantial investments in technology to make curbside shopping or in-store pickup through robotics more convenient for consumers. Physical stores became valuable assets for online orders fulfillment.

As part of their year-end financial review, Walmart announced that in FY 2022, the company plans to invest nearly $14 billion to increase supply chain capacity and automation to stay ahead of demand, improve the customer experience, and increase productivity.

For some time, Amazon has also recognized that they need to more aggressively engage in the grocery market share growth battle. Buying the 523 Whole Food chain was only a start-up skirmish. As I have stated in multiple articles and podcasts, Amazon could have done a much better job of integrating their Prime program with over 150 million members as a loyalty program into Whole Foods.

As a realization that they need to increase their activities in grocery, Amazon has quietly started opening a separate chain from Whole Foods which they branded Amazon Fresh. Eleven of these stores are now open and reports indicate that 28 more are on the way.

Technology has also been at the forefront for Amazon in their expansion in the FCMG sector. There are currently 26 Amazon Go fully automated grab-and-go stores in the United States and the first one just opened in London in the United Kingdom. For their Fresh stores, Amazon also introduced the Smart Dash Self-Checkout Shopping Cart.

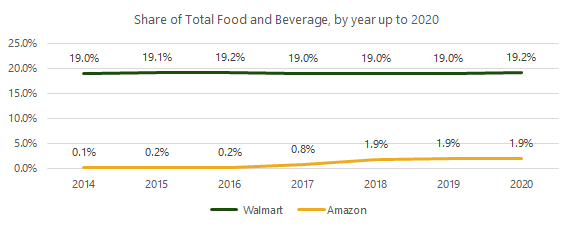

As below data confirms, Walmart with their physical store assets is currently winning the grocery wars

The battle between Amazon and Walmart will be interesting to watch as on multiple levels it is a microcosm for the future of online versus physical retail. Ultimately, it will reinforce the growing importance of stores as fulfillment and direct consumer experience centers.

E-Commerce Will Not Eat All Your Groceries

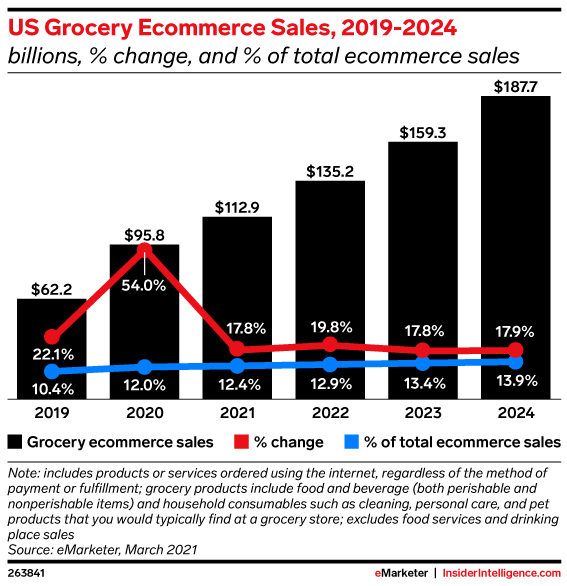

Contrary to popular industry speculation, all retail sales are not moving online. For USA grocery specifically, in 2021 online sales will cross over $100 billion, growing at nearly 18%. This is after a major growth spike in 2020 of 54%.

The growth rate for online grocery is projected to hold steady at 18% through 2024 when this sector will represent nearly 14% of all ecommerce sales. Even with all this growth, by 2023, 88.8% of all grocery sales in the United States will take place in physical stores.

Technology Will Continue to Lead Grocery Transformation

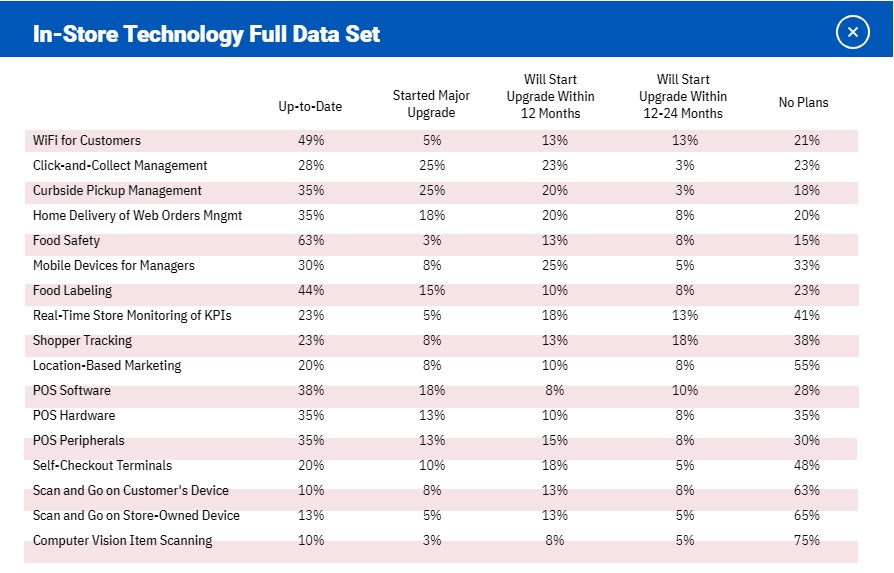

As the 2020 RIS News Grocery Technology Study confirms, the shopping list for innovation continues to grow.

Of interest on this list is the focus on WIFI to engage consumers in the store, the growth of curbside retail, and the emerging technologies in scan-and-go and computer vision making their appearance.

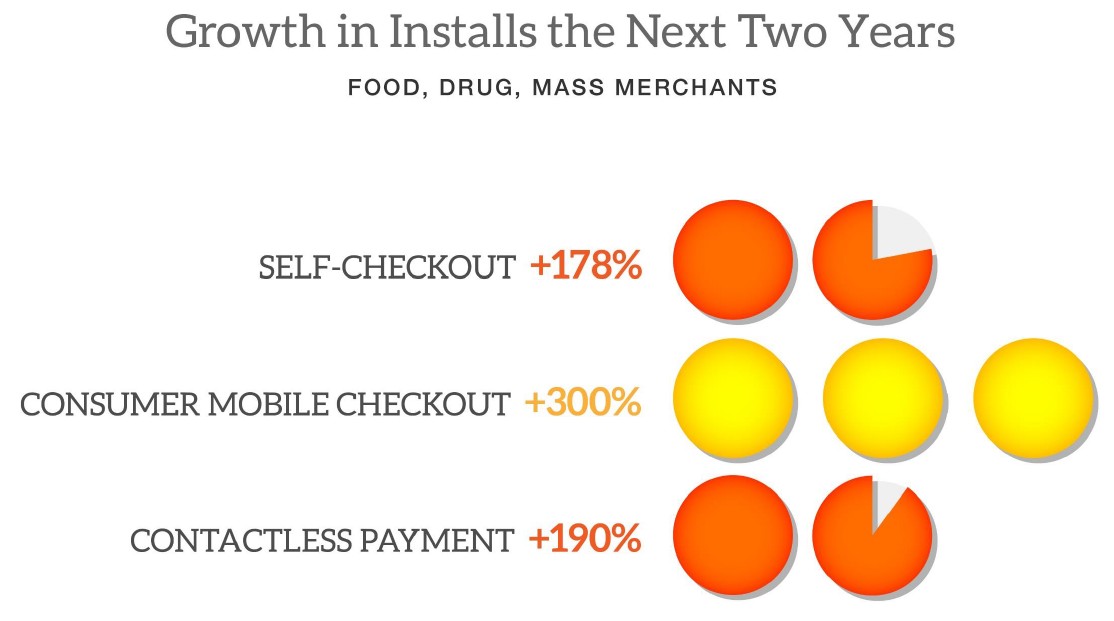

With the pandemic, contactless became the operative word for retail in 2020. Not surprisingly, as confirmed by new research from the IHL Group, the pace of self-checkout deployments that was already underway pre-COVID will accelerate over the next two years.

Partially, these trends are possible because of new innovations in artificial intelligence coupled with computer vision in protecting these self-service journeys from theft.

The Power Brokers of the Retail Channel

The smartphone ushered in the era where the consumer became the power broker of the retail model. Mobile devices allow consumers to walk into stores and instantly decide whether to purchase products in that physical location or from a competitor online while standing in front of the products. Additionally, shoppers, especially for more expensive purchases, often do their home online and are better educated that the store associate they encounter in the store.

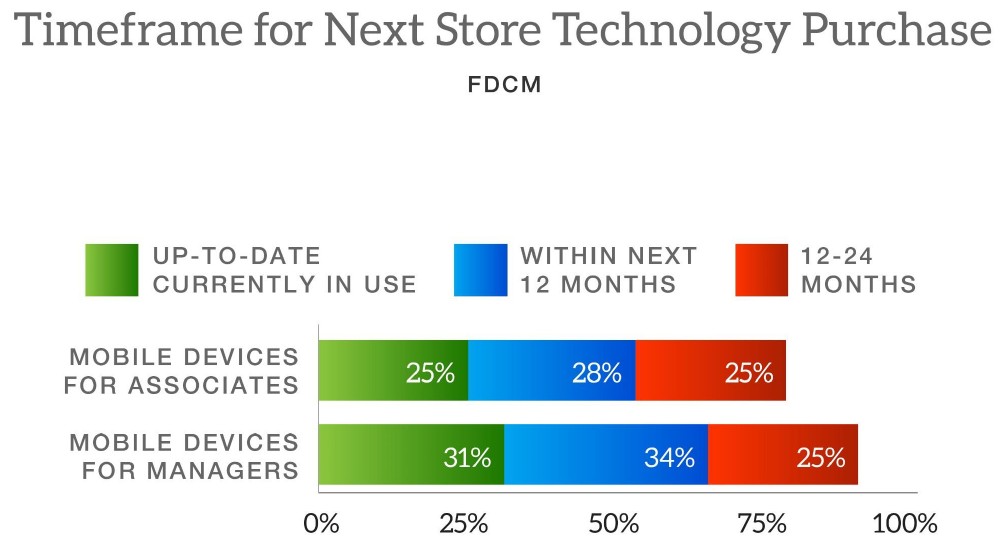

It is refreshing to see in the new research the intensified focus on providing mobile tools in store for associates and managers to elevate the digital conversation with the consumer and turn it into a sale.

A key challenge that consumers find in grocery is out-of-stocks. Excluding the four-week surge, grocery consumers reported experiencing an out-of-stock on 1 in 4.2 items they were looking for in 2020. Inventory visibility and accuracy will be a critical component of the success mix that grocers will need to fix going forward. Again, advancements in both computer vision and RFID technologies are able to help.

Being the largest retail sector, grocery will remain the most attractive for new entrants and also the most competitive. To understand this, study the success of Aldi, Lidl, and Trader Joe. For more insights and data on the future of grocery check-out the Rethink Retail Podcast.