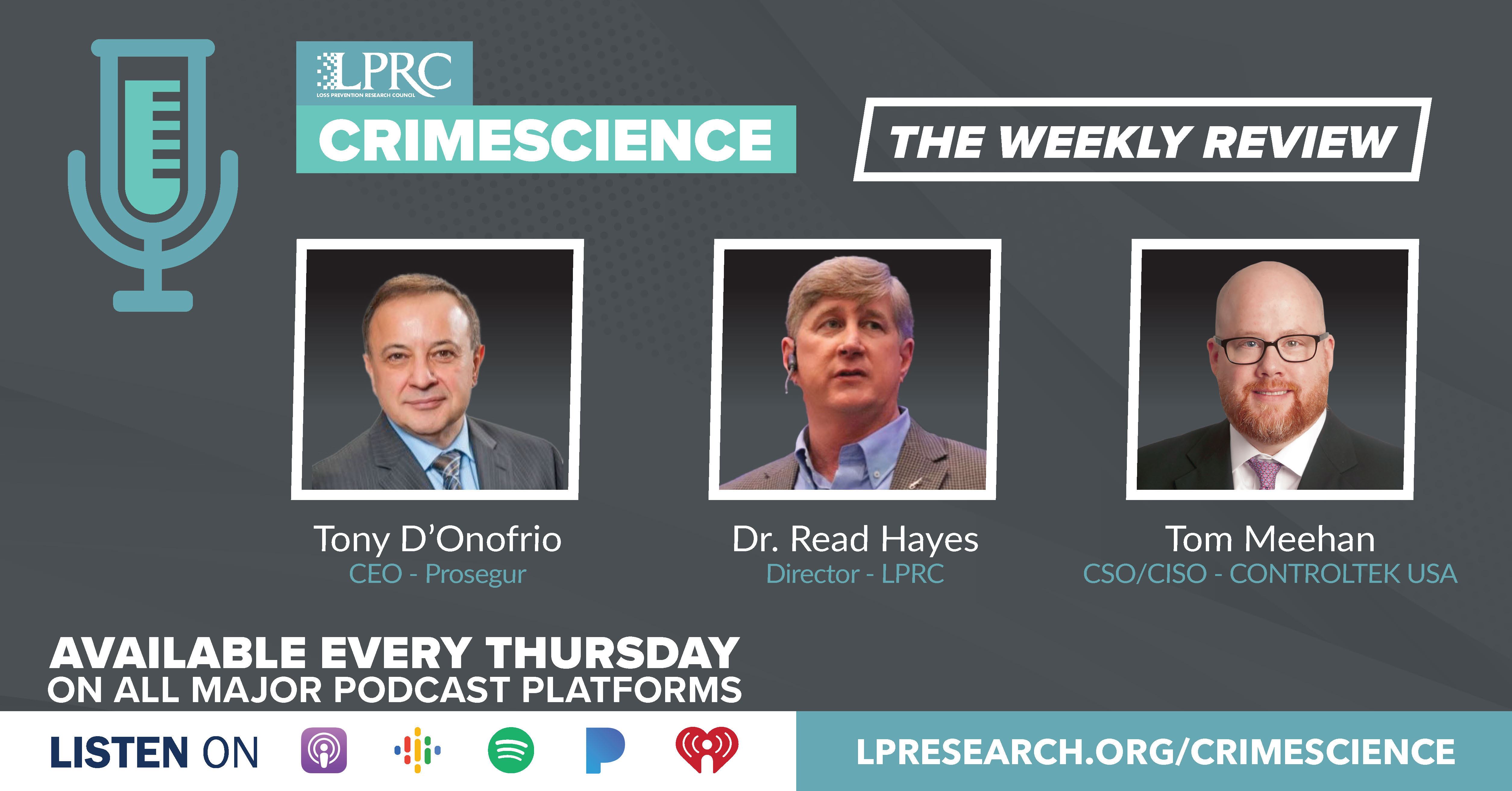

Loss Prevention Research Council Weekly Series - Episode 93 - Deloitte the Top 250 Global Retailers 2022

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

LPRC is Hosting an Open House! Ukraine and Russia Crisis Continues to Affect World! In this week’s episode, our co-hosts discuss the vaccination numbers across the world and country, New Research in Actions are being written by LPRC Every Month, 2022 Economic Trends from Deloitte, and the Supply Chain Disruptions from Russian Invasion.

Listen in to stay updated on hot topics in the industry and more!

Deloitte Global Powers of Retailing 2022

https://www2.deloitte.com/global/en/pages/consumer-business/articles/global-powers-of-retailing.html

A favorite report every year is the Deloitte Global Powers of Retail research which summarizes the major economic trends and the state of the global top 250 retailers. From the 2022 edition, let’s start with the summary of economic trends for the new year as reported by Dr. Ira Kalish, Deloitte’s Chief Global Economic. In his own words,

We entered 2022 with high rates of inflation in the United States and Europe, continuing disruption of global supply chains, a shortage of labor in key markets, and a reversal of monetary policy in the United States and Europe. December 2021 and January 2022 experienced the worst outbreak of coronavirus infections, with the omicron variant, since the start of the pandemic. And yet retailers have reasons for optimism. Supply chain disruption is likely to abate. Inflation is likely to recede. Major economies are likely to grow at a healthy pace in 2022, especially as many consumers are flush with cash. And, despite political tensions between major countries, trade and cross-border investment continues apace, thereby allowing global retailers to enjoy the fruits of globalization.

On the major issues and outlooks in key markets:

On inflation and supply chains, the high rates of inflation in the United States and Europe are due largely to supply chain disruption, as evidenced by large price increases for goods but not for services. There are indications that supply chain disruptions may have peaked and will soon abate. Consumer spending on goods is lessening. Industrial production in East Asia is soaring, due partly to increased availability of inputs such as semiconductors. If supply chains revert to normal in the next 12-18 months, the rate of inflation should decline sharply.

On labor markets, in the United States, and also in some other countries, labor force participation is down, and businesses face labor shortages. Possible reasons include mass early retirement by older workers, fewer women working due to childcare responsibilities during the pandemic, fear of the virus, less migration, and a skills mismatch due to fewer low skill jobs and an increase in high skill jobs. A labor shortage would usually result in a big increase in wages. However, although wages have risen, the increase has been less than expected and not sufficient to drive up inflation. Some businesses have avoided wage increases by offering signing and retention bonuses. Others have invested in labor-saving or labor augmenting technologies.

On monetary policy, monetary policy is shifting in the United States, Eurozone, the United Kingdom, Canada, and Australia. This has entailed a commitment by central banks to reduce asset purchases and start interest rate normalization in 2022. It is an acknowledgement of strong economic growth and healthy labor markets, as well as concerns about inflation. However, most central bankers still see current high rates of inflation as temporary and likely to abate by 2023. Investors appear to accept this argument, as evidenced by market indicators of inflation expectations. Thus, there is reason to expect that borrowing costs will remain historically low.

On Fiscal Policy, fiscal policy in most countries has become less expansive, with Japan an exception. Government borrowing in the United States and Europe is therefore likely to decline this year, putting downward pressure on yields even as central banks stop buying bonds. Fiscal policy in the United States and Europe is becoming focused more on the longer term, with investments in infrastructure and human capital. Although fiscal contraction could have negative consequences for growth, the impact could be offset by a decline in consumer saving as households dip into their accumulated savings.

On global trade, global trade has expanded rapidly despite supply chain disruption and tensions between the United States and China. Global companies continue to engage in cross-border investment, including direct investment into China. However, they are starting to diversify supply chains away from China, and into India and other countries in Southeast Asia, Mexico, and home markets. The United States has been cautious about liberalizing trade with China

and Europe but is starting to move in that direction.

In terms of outlook by region:

United States. We can expect moderate growth, slower than previously expected due to the negative impact of the omicron variant in the first quarter of 2022. The rate of inflation should fall as the year progresses. Labor shortages are likely to persist, especially due to limited immigration. Consumer spending on goods is likely fall as consumers shift back toward spending on services.

Europe. In the first quarter the economy in Europe is likely to be restricted by omicron, but subsequently the rate of growth (and increase in consumer spending) should rebound nicely. The rate of inflation will also fall as the year progresses, especially if energy prices peak.

China. There is reason to expect much slower economic growth in 2022 than in 2021, due largely to troubles in the country’s huge property market. Unlike elsewhere, monetary policy will be more expansive and less concerned about inflation, which is currently low. Demographics are a major concern, with China having seen fewer births in 2020 than in any year since 1961; and there could be long-term negative consequences for economic growth, consumer demand, and the health of the pension and healthcare systems.

Switching to the latest list of the top 10 global retailers for 2022:

- Walmart – growth rate of 6.7%

- Amazon – growth 34.8%

- Costco Wholesale – up 9.2%

- Schwarz Group which includes Lidl – up 10%

- The Home Depot – up 19.9%

- Kroger – Up 8.3%

- Walgreens Boots Alliance - Up 1.5%

- Aldi – Up 8.1%

- com – Up 27.6%

- Target – Up 19.8%

Seven out of the top ten retailers are from United States. Two are from Germany and for the first time one is from China.

The top 10 global retailers represented nearly 35% of total retail sales for the global top 250 retailers. On average they operate in nearly 13 countries.

In FY2020, the COVID-19 pandemic helped fuel growth of the Top 250 retailers at a faster pace than in FY2019. E-commerce specialists saw strong growth as consumer purchasing moved online. Food and drink retailers increased sales as consumption switched from the hospitality sector to in-home, and retailers in other sectors such as home improvement benefited from the consumer ‘stay-at-home’ focus. This was partially offset by falling sales in retailers operating in the fashion and luxury categories; those with significant travel retail operations; and those with little e-commerce capability.

The total retail revenue of the Top 250 companies reached US$5.1 trillion in FY2020, an increase of 5.2% over FY2019 on a sales-weighted, currency-adjusted composite basis. However, 69 companies reported declining sales, 14 more than in the previous year. The five-year compound annual growth rate (CAGR) for the period FY2015-2020, 4.7%. The threshold retail revenue to make it into the Top 250 list in FY2020, US$4.1 billion, increased by less than US$0.1 billion.

66% of the top 250 total revenue is from the Fast Moving Consumer Goods Sector which includes Food & Drug, convenience stores, etc. Apparel and accessories represent only 7% of the global top 250 retailers’ revenue, hardlines and leisure goods 21%, and diversified 5%.

In terms of the fastest growing retailers in the world in the top 250, the United States had 11 companies listed, followed by 5 in China and Russia each. The top 3 fastest growing retailers between FY 2015 and FY 2020 were Coupang Inc from South Korea, Reliance Retail Limited from India, and Wayfair from the United States.