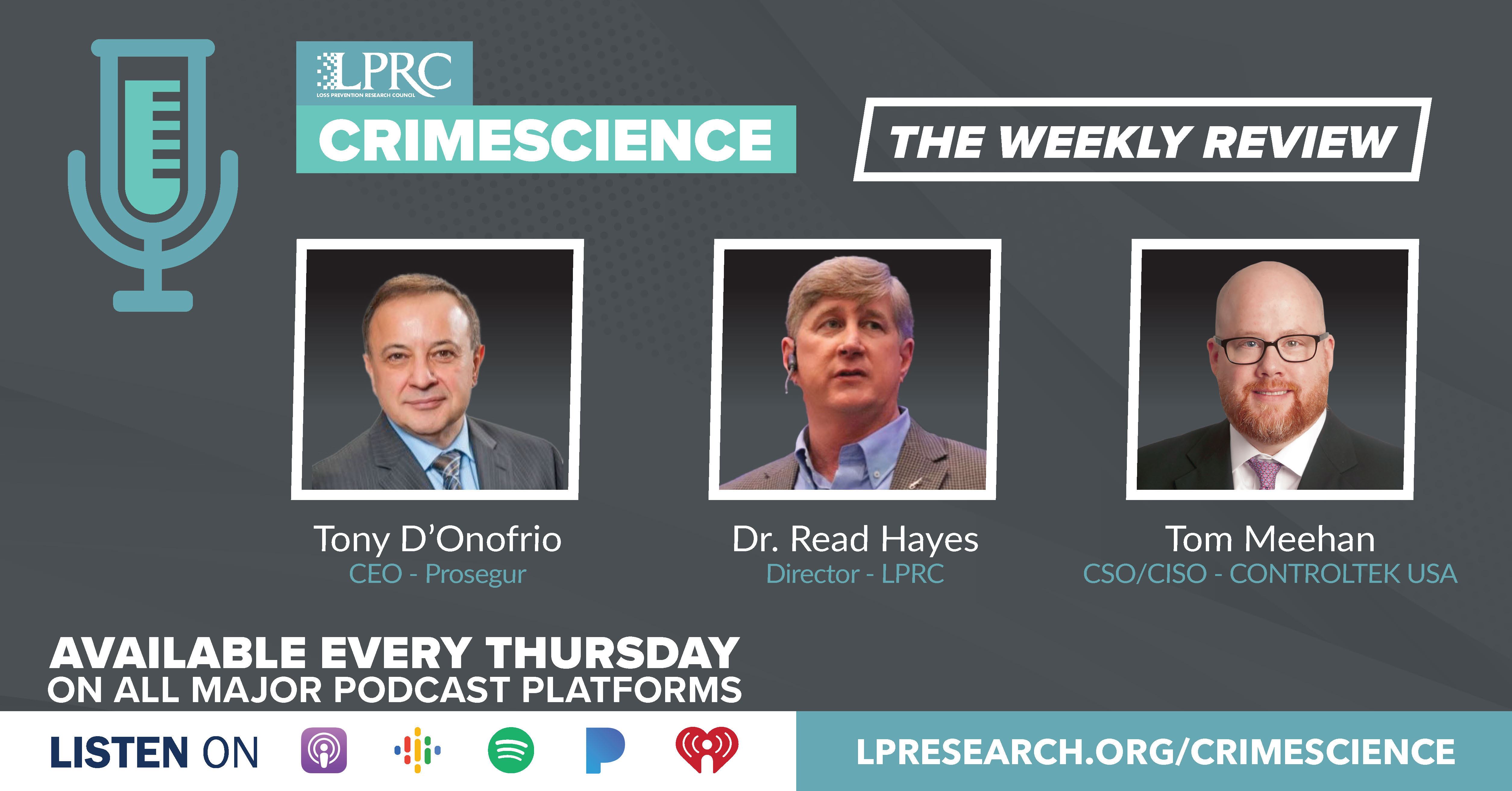

Loss Prevention Research Council Weekly Series - Episode 92 - Best Retail Employers and Winning Retailers Focus in 2022

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

LPRC IGNITE was a great success with great attendance! Ukraine and Russia Crisis Examined! In this week’s episode, our co-hosts discuss research into Cardio effects from Covid, Forbes lists best Large and Mid-sized Retailers to work for, Tech Investments in 2022, and Civil Unrest in Canada Causes Supply Chain Disruption.

Listen in to stay updated on hot topics in the industry and more!

10 Best Large and Midsized retail employers to work for in 2022

https://risnews.com/10-best-large-and-mid-sized-retail-employers-work-2022

Congratulations to these retailers that were listed as 5 best places to work for in 2022. The survey was done for all companies by Forbes in collaboration with Statista.

The top 5 best large American retailers to work for in 2022 were Costco, Trader Joe’s, HEB, Kwik Trip, and Wegmans.

The top 5 best mid-sized American retailers to work for in 2022 are Vera Bradley, Lush Fresh Handmade Cosmetics, Build-a-bear, L.L. Bean, and Micro Center.

Again congratulations.

Brick-and-mortar helps drive strong global retail spend in 2021

https://chainstoreage.com/brick-and-mortar-helps-drive-strong-global-retail-spend-2021

Reaffirmation from Chain Store age that physical retail made a strong comeback in 2021.

Total retail spending around the world grew 9.7% to $26.031 trillion, according to eMarketer’s Insider Intelligence report. The increase outpaced eMarketer’s earlier forecast of 6.0% growth.

Pent-up demand from in-store shoppers helped drive the increase. In-store sales rebounded by 8.2% last year, to $21.094 trillion, more than was spent in 2019, the report.

By region, total retail sales in North America, the Middle East and Africa rose 15.2% year-over-year. The next biggest increase was in Latin America, where year-0ver-year sales increased 12.2%.

According to eMarketer, brick-and-mortar will grow between 2.6% and 3.4% for the remainder of its forecast, out to 2025. The channel will see more new spending this year than e-commerce ($702.17 billion versus $603.68 billion), despite its slower growth rate.

How Winning Retailers are Racing Ahead with IT Innovation in 2022

https://www.ihlservices.com/product/racingaheadinnovation2022/

Some interesting new data from the IHL group on both the retail industry in a recent webinar and research on the state of the retail industry and technology

- Total retail sales increased a very robust 18% in 2021. Strongest growth was in specialty soft goods which includes apparel which grew 48%. Convenience and Gas grew nearly 37% and restaurant sales grew over 32%. Even what was once challenged department stores, grew their sales over 22% in 2021.

- The top retail challenges at the start of 2022 are inflation in wages / product costs, continued port issues leading to product and packaging shortages, continued labor shortages which are expected to increase automation, chip shortages in all areas and continued COVID protocols.

- Going forward consumer expect to continue to shop omnichannel. North America leads the world in stores being more important than digital. In the essential category which is grocery, drug, convenience, etc, 64% plan to shop in store in 2022 and 36% in digital channels. For apparel in North America, 55% plan to shop in store and a surprising 45% digitally. The highest shift to digital channels is taking place in Asia Pacific and Latin / South America.

- The top 5 pain points for essential stores in store shopping in 2022 are product availability , lines in stores, COVID safety in store, wrong prices and lack of staff. For click & collect, the five pain points are wait times / slots, substitution costs, fewer promotions & discounts, lines / delays in pickup, and can’t add to existing order.

- The top 5 pain points for apparel in store are size availability, lines in store, not enough dressing rooms, lack of staff, and wrong prices. For apparel delivery the top 5 pain points are unknown fit, limited return options, images that don’t match reality, delivery too long, and inventory visibility / accuracy.

- What distinguishes retail winners which are defined as retailers that grew 10% in their sales in the previous years are their investment in technologies. For retail winners, nearly 43% of their sales are coming from digital journeys which is 26% higher than below average retailers.

- Retail winners are 120% more likely to have optimized their local delivery, 67% more optimized their ship from warehouse and 39% optimized BOPIS / Click and collect services. Optimizing these services means these retailers are driving higher margins.

- Retail winners have a 95% higher IT spend than average retailers, 376% more store IT spend, 110% more BOPIS and 58% more local delivery IT spend.

- Retailer winners believe and are investing in mobile devices at 107% for managers, 72% for store associates and 53% for mobile POS.

- Winners trust consumer mobile self-checkout. Retail winners are 81% more likely to have mobile checkout via app enabled for customers.

- IT spend had a once in a generation increase. Since 2019, IT spend budgets are up 40%. There is a 48% increase in new innovation spend since 2019, that is new technologies.

For 2022, North America retailers are expected to spend $25 billion on Software as a Service / Cloud solutions.