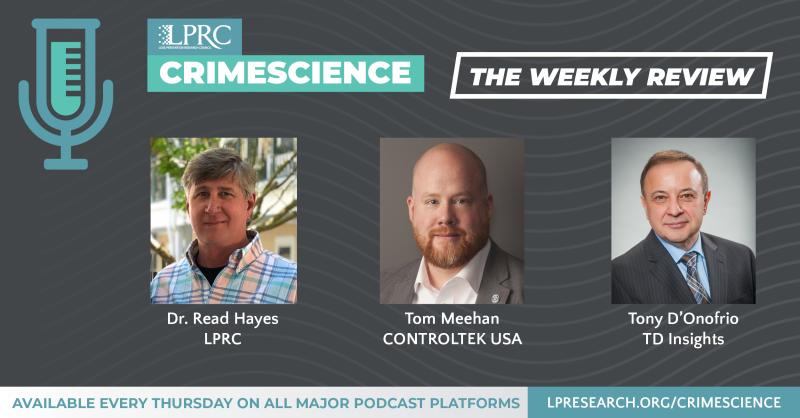

Loss Prevention Research Council Weekly Series - Episode 82 - Thanksgiving Weekend Shopping Takeaways and the New Variant

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Black Friday Brought Shoppers Back to Stores

https://www.wsj.com/articles/black-friday-brought-shoppers-back-to-stores-11638111602

From the Wall Street Journal here is some deep analysis on what happened on Black Friday and this holiday shopping weekend. The good news is that stores are back.

As the Wall Street Journal wrote, U.S. shoppers spent more time and money at bricks-and-mortar stores over the Thanksgiving holiday weekend than the same period last year, though foot traffic remained below pre-pandemic levels.

The rebound marks a reversal from 2020 when the pandemic accelerated a yearslong shift of holiday spending occurring online at the expense of in-store shopping. It also shows retailers were able to secure spending on the key Black Friday selling day, analysts say, even though discounts weren’t as prevalent this year and they spent weeks nudging customers to shop earlier in the season.

RetailNext, a firm that tracks shopper counts in thousands of stores with cameras and sensors, said store traffic rose 61% this Black Friday compared with last year but was down 27% from 2019. Sensormatic Solutions, another firm that tracks store traffic, said Black Friday traffic rose 48% from last year, but was 28% lower than in 2019.

The Thanksgiving holiday weekend was also the first time in years that online retail sales didn’t increase from the prior year, according to some industry estimates. Online Black Friday sales fell to $8.9 billion from $9 billion last year, according to Adobe Inc., while Thanksgiving Day online sales were roughly flat at $5.1 billion, the first time sales didn’t increase since Adobe started tracking the figures in 2012.

Black Friday online spending falls amid early promotions and deals

https://www.chainstoreage.com/black-friday-online-spending-falls-amid-early-promotions-and-deals

The data quoted by the Wall Street Journal was reinforced in analysis delivered by the Chain Store Age.

As they said, E-commerce sales got off to a tepid start over Thanksgiving weekend following an unusually early start to the holiday shopping — and deals and discounts — season.

Total U.S. online spending on Black Friday, Nov. 26, reached $8.9 billion, according to the Adobe Digital Economy Index. The total was at the low end of Adobe’s predicted range and a slight decrease from $9 billion in online Black Friday spending tracked by Adobe in 2020.

While online spending on Black Friday was down from last year, in-store traffic showed a big rebound. It rose 47.5% year-over-year

Adobe analysis also indicates that online spending on Thanksgiving Day, Nov. 26, remained flat year-over-year at $5.1 billion. It was up 21% from $4.2 billion on Thanksgiving Day 2019.

Over Thanksgiving weekend, consumers spent $4.5 billion online on Saturday, Nov. 27, down 4.3% year-over-year. They spent $4.7 billion online on Sunday, Nov. 28, down 0.5% year-over-year. This marks the first time where Adobe has reported both Thanksgiving and Black Friday as not seeing an increase in online spending year-over-year.

Adobe still expects Cyber Monday, Nov. 29, to be the biggest online shopping day of 2021, with between $10.2 billion and $11.3 billion in online spend.

One segment of Black Friday digital sales which did show growth is mobile sales. According to Adobe, smartphones accounted for 44% of all online sales on Black Friday, which is up 11% year-over-year. Smartphone visits accounted for a 62% share (up 2% year-over-year) compared to desktop’s 38% share of Black Friday digital sales.

Over the weekend, curbside pickup grew 33% over pre-pandemic levels and was used in 18% of online orders (for retailers who offer the service). Last year at this point, it was used in 25% of all online orders.

Salesforce analysis shows generally similar results. According to Salesforce, U.S. online sales rose 1% year-over-year to $6.9 billion on Thanksgiving Day. Interestingly, Salesforce reported more robust 5% year-over-year growth to a total of $13.4 billion spent by online consumers during Black Friday. Salesforce has similar projections for Cyber Monday spending, predicting U.S. consumers will spend $11 billion on Cyber Monday, flat compared to 2020.

Black Friday 2021 illustrates shifts in consumer behavior and changing retail strategies

https://www.emarketer.com/content/black-friday-2021-illustrates-changing-consumer-behaviors

Great analysis from e-marketer on the shifts in consumer behavior and changing retail strategies. As they said:

A shopping holiday in transition: Part of the drop in in-store traffic compared to 2019 is likely related to more of overall spending moving online.

- Consumers are also spreading their spending over a greater length of time. Part of that reflects supply chain issues and inflation—likely short-term challenges—and consumers becoming more savvy about bargain-hunting wherever those deals may be found.

- Ahead of Black Friday, 63% of holiday shoppers had fallen victim to stockouts. Through Black Friday, out-of-stock messages on ecommerce channels are up 124% compared to pre-pandemic levels, per Adobe, with appliances and electronics among the most likely categories to be sold out.

- 54% of shoppers are experiencing higher prices than last year and 37% are finding less discounts than last year.

- Regardless of their reasoning, 61% of shoppers had begun buying holiday gifts before Thanksgiving, according to an National Retail Federation study.

Thanksgiving shopping on the decline: With retailers such as Best Buy, Walmart, and Target deciding to close their stores for the holiday, in-store traffic dropped 90.4% from Thanksgiving Day 2019.

- While Target has already said this change is permanent, if the retail season is weaker than expected—perhaps if Omicron, the new Covid variant, raises concern levels— some retailers might rethink their Thanksgiving plans.

- Shoppers spent $5.1 billion in ecommerce transactions on Thanksgiving Day, flat compared with last year, per Adobe—though last year, many weren’t taking part in larger holiday gatherings.

Covid is (still) a thing: Those NRF projections were made before Omicron, the troubling new Covid-19 variant detected in South Africa, sent markets tumbling on Friday in their largest plunge of the year.

- Sensormatic found that, on the whole, consumers were more likely to flock to stores in regions less concerned with Covid-19. The South’s shopper traffic was closest to 2019 levels; the Midwest, West, and Northeast followed, in that order.

While retailers have some reasons for concern, it’s not all doom and gloom:

- Adobe is expecting Cyber Monday to be the biggest day for ecommerce this year, delivering $10.2 billion to $11.3 billion in sales.

- The NRF projects November and December holiday sales will be 8.5% to 10.5% higher than last year, which, if accurate, would be the greatest year-over-year growth on record.

The big takeaway: The holiday season is stretching out and flattening out.

- The data backs that up: In November’s first three weeks, US sales rose 10% versus 2020, per Salesforce, with consumers shopping earlier mindful of supply chain challenges and stockouts.

- There have been 19 days this holiday season with ecommerce activity surpassing $3 billion, per Adobe; at this point last year, just five days had online sales at that level.

- 70% of consumers told Deloitte that they began holiday shopping before the end of October, compared with 66% in 2020 and 61% in 2019.

- Even if the supply chain isn’t an issue in 2022, this elongated holiday season is here to stay. It lets retailers bank sales earlier in the season, and consumers have shown they’ll shop whenever the best deals can be found.

A New Variant is Spreading! LPRC Kickoff is January 19th in NYC Bloomingdales Flagship Store! In this week’s episode, our co-hosts discuss these topics and more, including the vaccination numbers in South Africa allow more variants, Holiday Shopping Online Trends are Analyzed, Discounts were Smaller this Year, and a Continuation of the bitcoin city. Listen in to stay updated on hot topics in the industry and more!