Loss Prevention Research Council Weekly Series - Episode 60 - Coronavirus Origin and Latest on RFID in Retail

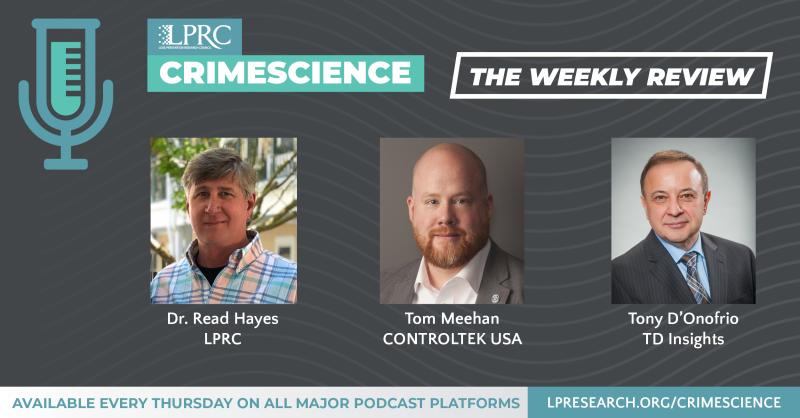

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

The Power Of Social Trust

https://infographicjournal.com/the-power-of-social-trust/

How often do we ask friends and friends before buying new products and services? That percentage is a very high 49%.

What do we tend to ask for advice more frequently: Products or services? Guessed this correctly with 68% saying services and 32% products.

Do we rather listen to celebrity or expert we have never met before or to a friend? 85% listen to friends, 15% to a celebrity or expert they never met before.

How likely is it for us to buy online if it was a product or service that was reviewed by a friend? It’s an amazing 71% that say very likely to likely.

Top 5 categories that people want advice on are electronics and household appliances, health and beauty products, cars and transportation, food and drinks, and medical and personal care.

Which Weapons are most Commonly Used for Homicides?

https://infographicjournal.com/which-weapons-are-most-commonly-used-for-homicides/

From FBI data in 2019 on analysis of 13,922 homicides. 10, 258 of these homicides were committed using a firearm.

Nearly 46% were with a handgun. Nearly 24% were with unknown type of firearms. Shotguns 1.4%. Rifles nearly 3%. After firearms it was knives and cutting instruments at nearly 11%, just over 11% used other weapons, and just over 4% used hands, first or feet.

Study: Consumer appetite for brick-and-mortar retail remains strong

https://chainstoreage.com/study-consumer-appetite-brick-and-mortar-retail-remains-strong

Summary research published in Chain Store Age from a YouGov study found that brick-and-mortar continues to be the go-to method (78%) for purchasing everyday essential items such as food, drinks toiletries and more.

Conversely, online retail channels are the preferred channel (72%) for discretionary items such as shoes, clothing, and electronics (72%).

The study found that the top reasons people shop in brick-and-mortar include physically experiencing products (62%), the ability to try things in store (53%) and speed of purchase (45%).

Additional findings are below.

Globally, women have much stronger online retail purchase behavior versus men for a variety of essential and discretionary product categories. Importantly, the biggest differences show up among the most penetrated categories online including personal care, clothing, and cosmetics (41% of females vs 25% of males).

Delivery charges and the inability to physically experience products ranked highest in terms of online purchasing barriers (46%). While many see convenience as a benefit by limiting the need for a trip to the store, there are times that delivery waits become a barrier, especially when shoppers’ needs are immediate.

From Accenture research, here is the latest on Retail RFID.

https://www.accenture.com/_acnmedia/PDF-155/Accenture-RFID-In-Retail.pdf

North America leads the world in RFID adoption which in 2020 was at 93%. Adoption in North America is broken down with 7% piloting, 37% in the middle of implementation, and 47% fully deployed.

Asia Pacific RFID adoption is at 77% with 6% piloting, 25% implementing, and 47% in full adoption. For Europe RFID adoption is also at 77% with 8% piloting, 37% implementing, and 32% in full adoption.

Interesting for North America, full adoption in 2018 was at 28% which jumped to 2020 to 47% of retailers having fully deployed RFID.

During the pandemic, retailers across geographies have used RFID to enhance their omnichannel operations. In the past two years, the number of omnichannel capabilities retailers offer have increased significantly, with 66% of RFID adopters and piloters now offering five or more services (including BOPIS, ship from store, ship to store, reserve in store, mobile app purchasing and deliver to home) compared to just 39% of non-RFID adopters and 22% of adopters and piloters in 2018.

With RFID offering real-time accuracy of almost 100%, it’s no surprise that the technology is being leveraged to improve customer experience for omnichannel services. By knowing where their stock is at any given moment, retailers can guarantee availability across the channels and nodes within their networks, whether in store or online. There is also value to be captured by way of shipping closest to the destination, reducing split shipments and allowing pick up in store to increase basket size.

Due to higher adoption, expanded use cases and increased omnichannel enablement, the return on investment for the technology continues to rise. Retailers that have fully adopted RFID are reporting more than 10% ROI compared to 9.2% in 2018. When retailers “layer” the use cases, specifically, those that have enabled five or more omnichannel shopping experiences, they are seeing a 20% higher ROI compared to retailers that have only paired the technology with four or fewer omnichannel shopping experiences.

The research shows a link between the level of RFID maturity and the level of ROI. In North America and Asia-Pacific, where RFID has a higher level of maturity (full implementation over piloting), retailers are exhibiting a 17-22% higher ROI compared to Europe, where retailers have not reached as high of a level of maturity in their adoption of the technology.

We also found that retailers that have engaged with suppliers on source tagging are seeing a higher ROI (16% higher) than those that have not. Full adopters of RFID have all moved to source tagging, and overall, 45% of retailers say they are engaging with their suppliers on source tagging.

What is next for RFID?

For softlines retailers, 24% plan to use RFID in collobaration with blockchain, and 22% plan to use it for supply chain and analytics, self-checkout, and improving engagement with smart technology.

For hardlines, 33% its collaboration with blockchain, 28% supporting omnichannel fulfilment, 23% improving customer engagement with smart technology, and 19% reducing stockouts.

For grocers, 45% intend to use it for reducing stockouts, 36% improving customer engagement with smart technology, 33% collaboration with blockchain, and 24% inventory tracking and visibility.

COVID-19 has had a direct impact on RFID adoption, with 46% of respondents indicating that they have focused on RFID in recent months and an additional 24% indicating it is currently under consideration. RFID interest is emerging across segments, for instance, 56% of grocery is now focusing on RFID as a result of the pandemic. This renewed attention has been a boon as 87% of respondents said focusing on RFID enabled them to deliver better omnichannel experiences during the pandemic.

Who influences us most on selecting goods or services? What are the top reasons for people shopping in Brick and Mortar? In this week’s episode, our co-hosts discuss these topics and more, including the New Update on the Coronavirus Origin, an FBI Report Identifies Most Used Weapons for Homicides, European Nuclear Weapon Locations Shared on Education Website, and New Upgrades in Energy Grid Cyber Security are Occurring. Listen in to stay updated on hot topics in the industry and more!