Loss Prevention Research Council Weekly Series - Episode 166 - Ten 2024 Critical Risk Scenarios for the Global Economy

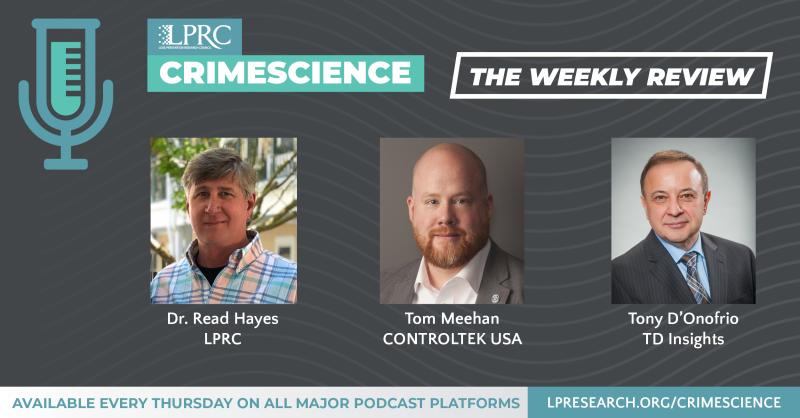

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

This week I want to focus on a very important new white paper from the Economist Intelligence Unit on the ten critical risk scenarios for the global economy in 2024.

As they state, EIU’s operational risk scenarios evaluate the events that could have a severe impact on its core economic and geopolitical forecasts, challenging the operations of businesses worldwide. In 2023 resilience among consumers and a gradual fall in inflation reassured uneasy investors and supported modest global growth. We expect stable, but unspectacular, global growth to continue into 2024 as economic uncertainty recedes and major central banks begin to lower policy rates in the second half of the year. This white paper explores how geopolitical tensions, the advent of new technologies and persistent environmental threats could upset the outlook for 2024.

Scenario one: monetary policy tightening extends deep into 2024, leading to a global recession and financial volatility

Moderate probability; High impact

In major developed countries, the reduction of central banks’ balance sheets could result in a sharp sell-off in the sovereign bond market and increase risk premiums in 2024, especially in highly indebted European economies. This could lead to a widespread asset-price crash, prompting a global recession.

Scenario two: a green technology subsidy race becomes a global trade war

Moderate probability; High impact

Western economies are rolling out generous incentives for businesses to invest in clean energy technologies by boosting domestic industrial capacity and enabling greater competition with China, which is the leader in the production of many green technologies.

Scenario three: extreme weather events caused by climate change disrupt global supply chains

High probability; Moderate impact

Climate change models point to increased frequency of extreme weather events. So far these have been sporadic and in different parts of the world, but they could start to happen in a more synchronised manner. Severe droughts and heatwaves have already weighed on crop yields, and the return of El Niño could exacerbate weather events and lead to record-high global temperatures in 2024.

Scenario four: industrial action spreads, disrupting global productivity

High probability; Moderate impact

High global commodity prices, continued supply-chain disruptions, high food prices and continued currency weakness against the US dollar for some countries will continue to fuel discontent in 2024-25. Wages have not risen as quickly as inflation in most countries, making it harder for poorer households to purchase basic staples. This could spark social unrest, expanding the small-scale protests and industrial action already seen in Europe, the

US, South Korea and Argentina.

Scenario five: China moves to annex Taiwan, forcing a sudden global decoupling

Low probability; Very high impact

A direct conflict between China and Taiwan is unlikely in 2024, owing to the risks to all those directly involved. Nonetheless, tensions are high, and Taiwan’s elections in January may serve as a point of contention. Chinese military drills near Taiwan—including Chinese incursions into Taiwan’s air defence identification zone—raise the risk of a miscalculation that could spiral into a wider incident.

Scenario six: a change in the US administration leads to abrupt foreign policy shifts, straining alliances

Moderate probability; Moderate impact

A new administration could hold up global efforts to curb greenhouse gas emissions, step back from support for long-standing alliances, and abruptly withdraw US financial and military support for Ukraine, boosting Russia’s position in the war.

Scenario seven: stimulus policy failures in China lead to increased state

controls and diminished growth prospects

Low probability; High impact

China’s sluggish response to covid-19 shocks and the subsequent post-pandemic slowdown has shaken confidence in the government’s ability to communicate and guide markets. The breakdown in signalling increases the risk that the government, should it be faced with an economic recession, will have to opt for big-bang stimulus rather than rely on more subtle mechanisms to stabilise the economy and markets.

Scenario eight: the Israel-Hamas war escalates into a regional conflict

Very low probability; High impact

If the military conflict between Israel and Hamas evolves into a long drawn-out war involving a lengthy Israeli occupation of Gaza, other state and non-state actors may become involved in sympathy with the Palestinian cause. We assess the likelihood of Iran getting directly involved in the war as slim, but it could use its influence on proxies such as Hezbollah in Lebanon to prolong and expand the scale of the conflict.

Scenario nine: artificial intelligence disrupts elections and undermines trust in political institutions

Moderate probability; Low impact

Global firms and governments have rapidly begun to test and integrate generative artificial intelligence (AI) into existing platforms and processes. We believe that AI will augment (rather than replace) human capabilities, presenting an opportunity for firms to improve productivity. However, the widespread adoption of AI and its use in social media will raise the risk of a spread in disinformation campaigns via text, imagery, audio and video in the coming years.

Scenario ten: the Ukraine-Russia war spirals into a global conflict

Very low probability; Very high impact

Russia’s invasion of Ukraine has fuelled underlying geopolitical tensions and accelerated global fragmentation. Ruptured relations between Western countries and Russia have raised numerous military risks, including a cyber-attack on critical infrastructure, a serious miscalculation at the NATO border with Russia, and an inadvertent incident among one of a growing number of nuclear arm-capable states.

LPRC is all over the Media, this week our hosts discuss the continued growth of the LPRC! Also this week, our team looks at the 5 possible economic disasters, the LPRC is attending the LPM/LPF’s town hall, and their is great momentum from IMPACT. The hosts also go into a recap of the latest AP/LP news and industry conference takeaways.