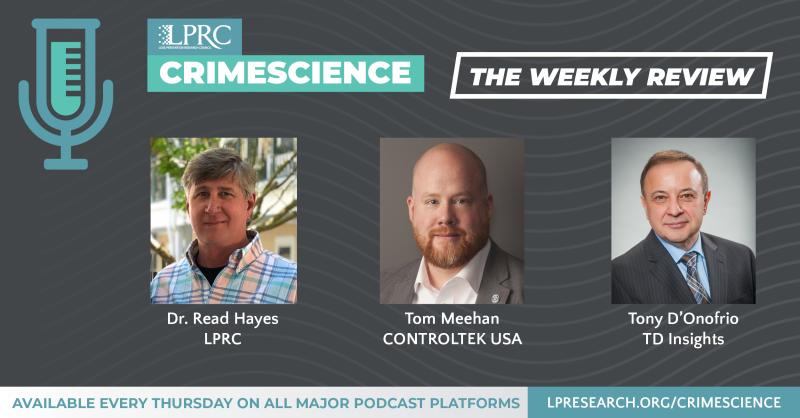

Loss Prevention Research Council Weekly Series - Episode 163 - Impact 2023 and Latest USA Retail Crime Trends

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Retail theft losses mount from shoplifting, flash mobs and organized crime

https://www.investors.com/news/retail-theft-losses-mount-from-shoplifting-flash-mobs-organized-crime/

Thank you Read. I want to first congratulate you, Chad, and the entire Loss Prevention Research Council Team for the excellent 2023 edition of impact. Amazing the crowd and also the great engagement. Love the passion, including from Mike Lamb who said correctly that is it time that we take our stores back against crime.

Retail crime is indeed a major challenge right now and in that spirit, let me focus this week on on a major article from Investor’s Business Daily on this topic. As they wrote, retail theft losses swelled to $112.1 billion in 2022, up 19% from $93.9 billion the year before. Those somber numbers come from the 2023 National Retail Security Survey, released in late September by the Loss Prevention Research Council and the National Retail Federation.

Retailers are cutting store hours and increasing security in response. Many are closing key locations. That comes at a cost to company performance, shareholders and the communities they serve. Employees feel uneasy. Customers experience more friction while being left with fewer resources and purchasing options.

"Everything points to a continuing increase in retail crime," said Cory Lowe, senior research scientist at the Loss Prevention Research Council.

In the 2023 survey of 117 retail brands, 88% reported shoplifters have grown more aggressive and violent than a year earlier. As for perpetrators of organized retail crime, ORC for short, 67% of respondents say they're growing even more violent and aggressive, compounding on increased violence from prior years.

"Retailers are seeing unprecedented levels of theft coupled with rampant crime in their stores, and the situation is only becoming more dire," wrote David Johnson, vice president of asset protection and retail operations at the NRF. "Far beyond the financial impact of these crimes, the violence and concerns over safety continue to be the priority for all retailers, regardless of size or category."

"Losses from theft are at historical highs," CEO Erik Nordstrom said in Nordstrom's August earnings call. "And I'd say we find it unacceptable, and it needs to be addressed" on a variety of fronts.

Target CEO Brian Cornell noted retail theft and organized crime are growing problems. The discount giant said it saw a 120% increase in theft incidents involving violence or threats of violence during the first five months of 2023. In May, Target warned that inventory shrink would reduce profits by more than $500 million compared to last year.

Target said it "invested heavily" to prevent theft and organized retail crime before the decision, including adding security team members, using third-party security and implementing theft-deterrent tools, such as additional locking cases. Target also partnered with Homeland Security Investigations.

Nordstrom closed its flagship San Francisco store at the Westfield San Francisco Centre on Aug. 27. That followed the closure of a nearby Nordstrom Rack in July. "The dynamics of the downtown San Francisco market have changed dramatically," Jamie Nordstrom, chief stores officer, told the media after the May announcement. The company still has 16 Nordstrom and Rack stores in the San Francisco Bay area.

The Westfield mall, in a statement to the Washington Post, blamed the closure on "the deteriorating situation in downtown San Francisco," as well as "unsafe conditions for customers, retailers and employees."

REI announced plans in April to close one of its best-performing stores in downtown Portland, Ore., citing shoplifting and higher crime. The outdoor retailer spent more than $800,000 on extra security in 2022, it told MarketWatch. A representative said REI also dealt with "unsuccessful lease renewal negotiations" and the security investments "weren't sustainable."

Whole Foods closed its flagship store in downtown San Francisco in April after opening the location in March 2022. "If we feel we can ensure the safety of our team members in the store, we will evaluate a reopening of our Trinity location," a Whole Foods spokesperson said in a statement.

Walmart CEO Doug McMillon warned CNBC last December that stores would close if theft doesn't slow. Walmart closed four Chicago stores in April, citing annual losses in the "tens of millions of dollars," but did not explicitly mention theft. In total, Walmart announced plans to shutter 22 stores in 14 states and Washington, D.C., through mid-July. Still, the retailer opened over 120 stores in the past year through Q2.

"Every bit of research shows that a small portion of the offending population is responsible for the majority of incidents," Lowe said. He cited one retailer's case management system that reported 10% of the known offenders were responsible for 90% of their losses.

The more sophisticated rings work on defined tasks within an established hierarchy with a ringleader to orchestrate operations, similar to racketeering enterprises, according to the NRF.

About 45% of organized retail crime (ORC) groups use online marketplaces for resale, based on the NRF and K2 database of known offenders and available fencing information. Some sites are taking preventive measures. By the end of 2021, Amazon.com (AMZN) required all new sellers to pass in-person verification to operate in major markets. As of December 2021, eBay (EBAY) requires sellers to provide personally identifying information.

Organized retail crime groups favor large national retailers and big box chains, according to the latest NRF and K2 Integrity Organized Retail Crime Report. They largely target everyday consumer goods with a favorable mix of monetary value and ease of theft and resale, NRF data shows. Some 81% of 116 identified organized retail crime groups exclusively steal general consumer goods.

The most targeted items have remained steady, NRF says. They include apparel, health and beauty products, infant supplies, accessories, houseware, home improvement products, and toys and laundry products. Brand names are more popular than generics.

Organized retail crime is less likely to target luxury goods, likely due to enhanced security, according to the NRF and K2 report. Only about 11% of the known ORC groups studied targeted luxury products.

"Organized retail crime will remain the top priority," the NRF wrote. "Expenditures against retail theft have factored into construction budgets, merchandising budgets, information technology, and staffing and training budgets. This is an enormously important and expensive effort for the retail industry. The continuing growth of organized retail crime and the damage it causes to communities dictate that something needs to be done."

Again the problem of retail shrink is real and great work is taking place at the Loss Prevention Research Council to get on the offense and indeed take our stores back.