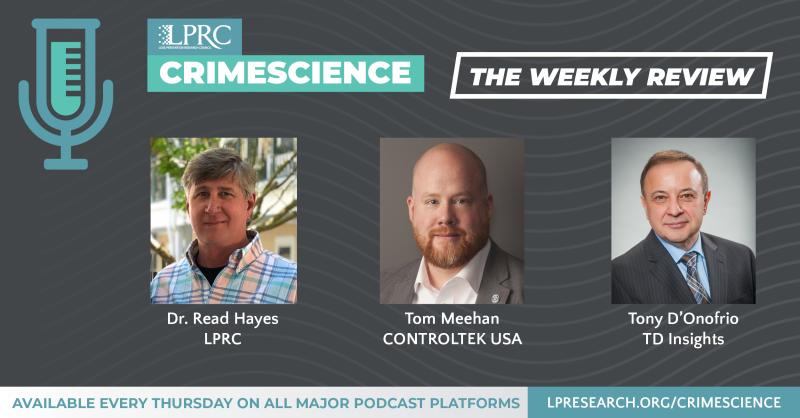

Loss Prevention Research Council Weekly Series - Episode 162 - Effective Retail Shrink Strategies and Holiday Shopping Predictions

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Costco, Lowe’s, Best Buy, and Tractor Supply are winning the battle against retail theft in a strikingly similar way

https://www.businessinsider.com/how-major-retailers-are-beating-rise-in-retail-theft-2023-9

Let me start this week with a brand new article from Business Insider on how four major retailers are fighting retail shrink. The article is titled “Costco, Lowe’s, Best Buy, and Tractor Supply are winning the battle against retail theft in a strikingly similar way.”

As the article states, the issue of retail shrink is top of mind of many retail CEOs.

"Organized retail crime is worse now than I've ever seen it," Tractor Supply CEO Hal Lawton told Insider in August.

"I've never seen anything like it," Lowe's CEO Marvin Ellison told the Goldman Sachs Retail Conference in September.

Best Buy CEO Corie Barry told analysts her company is "definitely seeing an increase" in theft at certain stores.

Taking a closer look, it's clear that Costco, Lowe’s, Best Buy, and Tractor Supply have several striking similarities – qualities that are helping them win the war on retail theft.

The article cites five similarities:

Store location and layout - With the exception of Best Buy, three of the four chains tend to have their stores in more suburban and rural locations that see fewer people. Both Lowe's Marvin Ellison and Tractor Supply's Hal Lawton said a lower population density contributes to the lower incidents of theft compared with busier locations. And with the exception of Lowe's, three of the four companies use a similar entrance and exit strategy that funnels every shopper past employees at cash registers or security checkpoints.

Big, heavy merchandise - A lot of the merchandise these four retailers sell is too unwieldy to be conveniently stolen. "Most people aren't able to walk in and throw a couple of those 50-pound bags over their shoulder and walk out," Lawton said. "Even if you do, you're stealing only $80 or $100."

Secure displays - For smaller or more expensive items, all four retailers aren't afraid of requiring customers to get help. Electronics are often sold at Costco with a pay-and-collect feature before they're ever placed in a cart, much like Best Buy keeps certain inventory off the sales floor until a customer requests it. And power tools at Lowe's and Tractor Supply are often kept on locked shelves, with Lowe's taking the extra step of selling some products that won't work unless activated at purchase.

Less self-checkout - Another big theme is the way each retailer handles self-checkout, which has been blamed for spikes in theft rates when it is introduced at stores. Self-checkout is minimal to nonexistent at Best Buy and Tractor Supply, while Lowe's has invested big bucks in its asset-protection technology to keep a sharp digital eye on the store. Costco saw a slight increase in inventory shrink after it rolled out self-checkout three years ago, but those rates have since reverted to the longer-term trend as the company has taken a more hands-on approach to monitoring what goes on in those lanes.

More staff per square foot - All four retailers prioritize having knowledgeable, helpful staff and have high levels of customer engagement. "We just have more employees in our stores and they just do an exceptional job of watching out over our stores," Barry said of Best Buy. Meanwhile, a typical Tractor Supply location may have as many as eight people working in a relatively small, 20,000 square-foot store. For Ellison at Lowe's the best investment was simple: "Having spent my entire adult life in retail at every level, the one thing that I understand clearly is that the greatest deterrent for any type of theft activity is effective customer service."

Holiday retail forecasts and predictions 2023

https://risnews.com/holiday-retail-forecasts-and-predictions-2023

Switching topics, let me go to RIS News on the latest holiday retail forecasts and predictions for 2023.

As they state, holiday retail sales are likely to increase between 3.5% and 4.6% in 2023 for the November-January timeframe, according to Deloitte’s annual holiday retail forecast. Last year the company predicted an increase between 4% and 6%, for comparison. Deloitte also forecasts e-commerce sales will grow between 10.3% to 12.8% year-over-year during the 2023-2024 holiday season. This will likely result in e-commerce holiday sales reaching between $278 billion and $284 billion this season.

Salesforce.com forecasts 4% global and 1% U.S. year-over-year online sales growth across November and December – reaching $1.19 trillion and $273 billion respectively. Sixty percent of these sales – or $714 billion globally – will be influenced by frontline workers in the store by a combination of creating demand and fulfilling online orders at retail locations.

Bain & Company forecasts nominal U.S. retail sales to slow this holiday season, with the lowest growth rate since 2018. Unadjusted seasonal sales are expected to grow 3% year-over-year in November and December, reaching nearly $915 billion, with 90% of the growth coming from non-store (e-commerce and mail-order) sales. However, adjusting for inflation, real U.S. holiday retail sales growth will be sluggish at just 1.0%, the company said, well below the 10-year average and the lowest real sales growth since the financial crisis.

Celigo which conducted an independent survey in July 2023 with 1,000 U.S. consumers nationwide, found this holiday season, an overwhelming majority of U.S. consumers are setting budget limitations on their holiday spending. Nearly 80% of survey respondents indicated they are determined to spend less than $5,000 on holiday shopping. Approximately half (49%) of the respondents said they plan to spend less than $1,000 on holiday shopping, while 30% revealed they have budgeted between $2,000 and $5,000 for gifts this year.

According to Salesforce, 17% of shoppers report they’ve already used generative AI for purchase inspiration. The company predicts the technology will influence $194 billion in global online holiday shopping spend as retailers use predictive and generative AI for operational efficiencies and personalized shopping experiences.

Blue Yonder’s 2023 Returns Survey, which polled 1,000 U.S. consumers, found 59% said tighter return restrictions have deterred them from making a purchase, while 71% lenient return policies significantly or moderately influenced their decision to purchase.

Salesforce found 88% of retailers say they will make their return policies stricter ahead of the holidays, which presents a risk. Retailers who rein in their return policies could see a slower start to the holidays, Salesforce said. Based on previous years’ data, it predicts that retailers with return windows of 30 days or less will see 7% fewer online sales in October and November.

Less than a week from IMPACT 2023, this week our hosts discuss some upcoming sessions for the event and what you can look forward to! Also this week, a recent article featuring top retail CEOs and their response to shrink, as well as their results. Some key takeaways, store location, design, layout, and types of merchandise are large determinants of shrink. Listen in to learn more!

Looking forward to seeing many of you at LPRC impact. And now over to Tom.