Loss Prevention Research Council Weekly Series - Episode 148 - Latest Retail Shrink Survey, San Francisco Store Closures and State of USA Economy

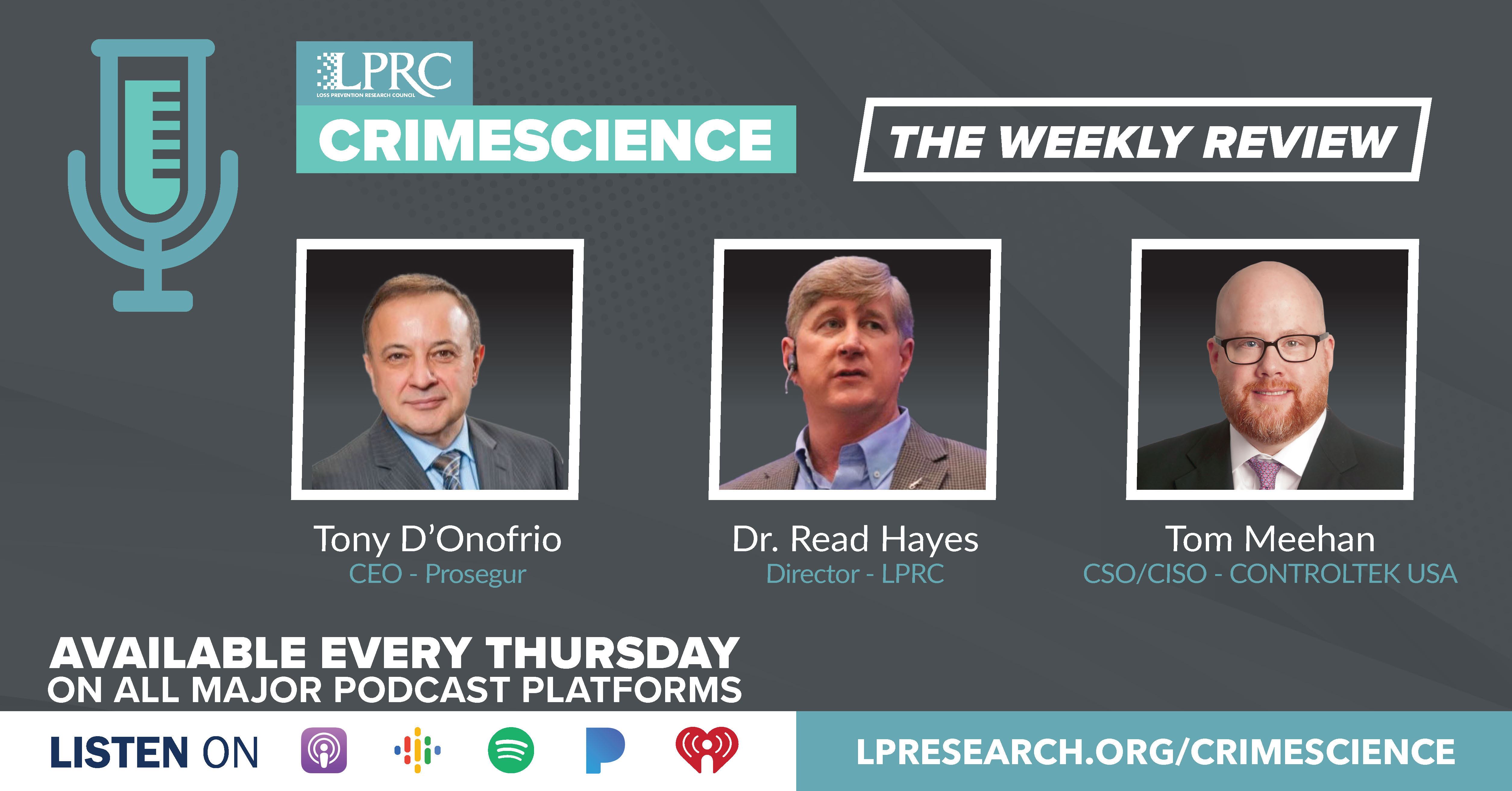

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Our hosts are traveling all over the world this week and discuss travel updates from the LPRC, challenges in San Francisco including store closures, shrink surveys from Jack Hayes International, and a Google versus Bing competition for AI deployment. A resurgence of bad actors using QR codes for malware has been seen so we discuss some best practices for preventing issues.

Jack L Hayes International Annual Retail Theft Survey

https://hayesinternational.com/news/annual-retail-theft-survey/

Let me start this week with a summary of the Jack L Hayes International 35th annual retail theft survey just published earlier this month.

The research found over 340,000 shoplifter and dishonest employee apprehensions in 2022 by just 26 large retailers, who recovered an astounding $288 million from these apprehended thieves.

Eighty-one percent of survey participants reported an increase in shrink in 2022 and this is reflected in their total apprehension and recovery statistics. Total apprehensions increased 45.6% and total recovery dollars from these apprehensions increased 70.5% in 2022. Many retailers returned to making shoplifter apprehensions post pandemic and focused more of their attention on external theft issues in 2022.

The survey revealed shoplifter apprehensions and recovery dollars from those apprehensions increased significantly in 2022, up 50.9% and 90.5% respectively.

Recovery dollars where no shoplifter apprehension was made, but merchandise was recovered, increased 44.1% in 2022.

On the employee theft side, there was an increase in 2022 in both dishonest employee apprehensions and recovery dollars, 18.0% and 14.7% respectively.

My favorite part of the report is the job applicant admission section.

To further evaluate the severity of employee theft, Hayes International analyzed over 19,000 randomly selected Applicant Review questionnaires which were pre-employment ‘honesty tests’ given to retail job applicants nationwide.

Of these 19,000 plus job applicants, just over 12,000 or 64% were rated as “low risk” and 3,700 or just over 19% were rated as “high risk”, due to their admissions of previous wrongdoings, and their attitudes regarding honest and dishonest behavior.

Over 18% of the high risk applicants agreed I have frequently associated with fellow employees who admitted they were stealing merchandise from the company.

Just over 9% of the high risk applicants agreed with I am not an honest person and might steal or cheat.

Nearly 27% of the high risk and an additional 8% of the low risk applicants said I could be tempted to steal from my employer.

Nearly 16% of the high risk and 4.5% of the low risk admit I have stolen merchandise within the past 3 years.

Previous theft admissions for the “high risk” job applicants totaled $256,050, or $69.20 per applicant, while the admissions for the group of 12,283 “low risk” job applicants totaled $71,930, or $5.86 per applicant. It is generally estimated the correct dollar amount for stolen money and merchandise is approximately 10 times the admitted amount. Therefore, based upon admissions made on The Applicant Review questionnaire, the average “high risk” job applicant was responsible for the theft of $692.03, compared to $58.56 for the average “low risk” job applicant.

Nordstrom Closing San Francisco stores as Cities’ retail pain grows

https://www.wsj.com/articles/nordstrom-is-closing-san-francisco-stores-as-cities-retail-pain-grows-5de1cba7

Switching topics let us go to the Wall Street Journal for an update on what is happening in San Francisco.

As they reported, Nordstrom is closing two stores near downtown San Francisco, including one in a prominent indoor shopping mall, the latest blow to the city’s retail landscape.

The closures also reflect the challenges that merchants face in key business districts in large cities across the country, as they deal with rising operating costs, concerns about crime, and foot traffic remaining well below prepandemic levels.

The loss of Nordstrom adds to the exodus of office and retail tenants out of San Francisco, following one of the slowest returns to in-person work in the country.

Dozens of stores have shuttered over the last three years in downtown and adjoining areas, including H&M, Abercrombie & Fitch, Gap and Crate & Barrel in and near Union Square. Other large retailers such as Whole Foods Market and Walmart this year have announced plans to close stores in urban areas.

Retail sales have fallen steeper in San Francisco than any other county in California.

According to one of the mall owners in the city, A growing number of retailers and businesses are leaving the area due to the unsafe conditions for customers, retailers, and employees, coupled with the fact that these significant issues are preventing an economic recovery of the area.

San Francisco has a lower violent crime rate than many other major cities, but one of the highest property crime rates. Robberies, motor vehicle thefts and larceny theft all increased in 2022 from the year prior, according to police statistics, while homicides were flat.

Large retailers have been vocal about the problems they face in urban and other locations regarding an increase in shoplifting and other community issues. Executives from chains such as Home Depot and Best Buy have said they were stepping up locking away items on store shelves to prevent theft and keeping close tabs on high-risk goods.

Interesting also from the Wall Street Journal article that In U.S. downtowns, foot traffic in April increased from the prior year but was still 25% lower than April 2019 levels.

NRF: US Economy Remained in Gear during first quarter

https://chainstoreage.com/nrf-us-economy-remained-gear-during-first-quarter

Finally, let me go to Chain Store Age for some good news on the USA economy for the first quarter.

According to the chief economist of NRF, the U.S. economy “remained in gear” during the first quarter even as GDP growth slowed to a modest 1.1% annual rate from the average 3% in the previous two quarters. The number could have been more than two percentage points higher, but many businesses reduced built-up inventories rather than producing or buying more goods.

Consumer spending, which accounts for two-thirds of GDP, grew 6.5%, up from 0.1% growth the previous quarter as disposable personal income saw annual growth of 8.4%.

Heading into the second quarter, employment numbers were better than expected despite high interest rates, with a net jobs gain of 253,000, a year-over-year wage increase of 4.4% and the unemployment rate of 3.4% tying January for the lowest in more than 50 years.

Inflation as tracked by the Personal Consumption Expenditures Price Index – the Fed’s preferred measure – was 4.9% year over year in the first quarter. That was down from 5.7% in the fourth quarter and far below the 6.4% seen a year earlier. The core PCE index, which excludes volatile food and energy prices, was at 4.7%.

Great to hear some good news.