Loss Prevention Research Council Weekly Series Episode 129 - Reimagining the Future of Retail and What Retail Employees Want

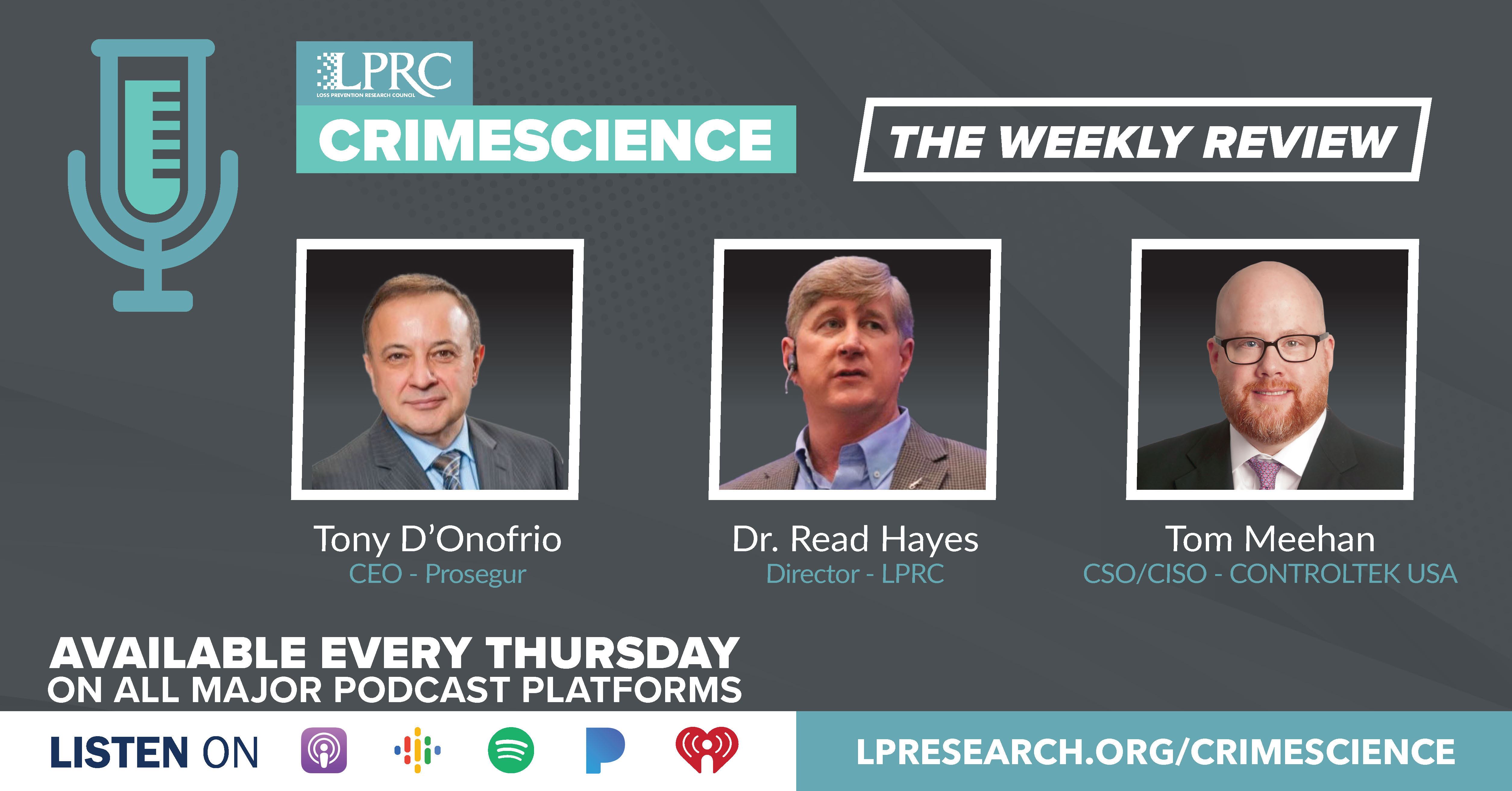

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Reimagining the Future of Retail

https://www.therobinreport.com/reimagining-retails-future/

Let me start this week with a synopsis of an article published in the Robin Report titled “Reimagining the Future of Retail.”

The future of retail will be shaped by a hybrid shopping model based on the new normal of highly interconnected experiences that serve specific target markets. Local, personal, smaller, curated, and customized. The cookie-cutter approach of building more and bigger stores does not resonate with today’s consumer mindset. The pandemic has left consumers with a new set of values, a higher expectation of what service means, and very little patience when things don’t go the way they should.

Consumers increasingly want variety in how, when, and where they shop, and they expect retailers to deliver a memorable environment that addresses their specific needs. Key are relevant, curated shopping experiences with abundant, personalized choices.

When asked about the future of malls, consumers are conflicted in that they want the endless aisles that online shopping provides, but at the same time they get overwhelmed by the number of choices. What they really want is a curated shopping experience. On the one hand, the idea of having countless stores to visit is appealing but schlepping through a big mall is not an experience that most consumers want to endure. Malls absolutely have a future and the ones that are more successful are an active part of the community they serve. Also, malls should look like they belong in the local market. It has been widely reported that entertainment features like movie theaters, amusement rides, museums, and skating rinks are great in-mall activities. Consumers in one market may want a marketplace of curated shops while others prefer an entertainment center with escape rooms and video arcades. Others may want wellness facilities including gyms, yoga studios, walk-in clinics, dentists and veterinarians.

In terms of physical stores, five characteristics are predicted

- Social Media Designed Stores.Winning physical stores are designed for shareable word-of-mouth and social media experiences. In China and North America, stores, restaurants, and shopping centers are being redesigned for social media sharing and it is working. Millions of shared impressions drive in-store and offline sales, traffic, and brand awareness.

- Five-Senses Experience. Environments activating all five senses will trigger the shopper’s journey in unique and imaginative ways. Grocery stores are at the top of the list for five-sense experiences.

- Meandering Design. Long, monotonous straight-line aisles of goods stacked from floor to ceiling will be replaced with circular pathways to create environments that foster discovery and exploration.

- Smart Store and Smart Customer Interactions.The state of in-store technology is now equal to customers’ technical prowess. RFID can be used for frictionless checkout or to find items in a store where you are shopping or at a store nearby, where it can be shipped to your home and office. With the growth of hybrid shopping, technological interconnectedness remains a key driver to build smart interactions. QR codes can be used to launch product videos, explain the composition of an item, demonstrate functionality, describe features, or show assembly guidelines. Salespeople with smart CRM tools can help shoppers find items and check out in the aisle. Understanding where the consumer is in their readiness for technology is a key consideration for retailers to be able to deliver meaningful enhancements.

Voices from the Front Line or what Retail Employees Want

https://risnews.com/voices-from-the-frontline-workforce

Switching topics, let’s summarize some interesting research from RIS News.

Almost half of U.S. frontline retail employees – and two-thirds of frontline managers – are thinking of leaving their jobs in the next few months. “Not enough workplace flexibility” is the No. 1 reason according to McKinsey.

Gartner points to five strategies in using technologies to retain retail employees.

- Flexible Scheduling - We know flexibility is important. Employee preference scheduling technology works in combination with employee shift swapping and shift bidding.

- Delivery of Corporate Communications - Investment in real-time communication tech enables retailers to communicate across locations with speed and agility. This is a boon not only to productivity, but also to safety, well-being, and overall engagement.

- Performance Management and Feedback -Many retailers are abandoning one-size-fits-all approaches in favor of more tailored performance management and feedback systems.

- Internal talent marketplaces - Gartner researchers estimate that by 2023, 15% of large global organizations will integrate their many business data sources to drive more AI-enabled talent matching in large-scale deployments of internal talent marketplaces.

- Pulse surveys to gauge employee sentiment - Moving away from the yearly or quarterly company reviews, companies are investing in technologies that allow for daily or even hourly pulse checks, enabling decision makers to design interventions based on timely, data-driven insights. According to Gartner, by 2023, 80% of enterprises with 2,500-plus employees will augment annual engagement surveys with pulse, focus-group-based or indirect methods to gauge sentiment.

As Joe Skorupa from RIS News summarized, “There are two major waves of disruption that have been triggered by the COVID pandemic, and these waves have forced retail to change more in the last two years than it has in the last 20. Many of the changes leveraged advanced technology to solve first wave problems, such as serving shoppers during lockdown, [and] resolving massive supply chain disruptions. Now, two years later, grocers are dealing with second wave issues such as the tight labor market, rising wages, the Great Resignation, and quiet quitting.”

UK consumer spending fails to keep up with Inflation

https://www.reuters.com/world/uk/uk-consumer-spending-fails-keep-pace-with-inflation-surveys-2022-12-06/

Finally, as I am still in Europe some news this week from the UK on retail and inflation as published by Reuters.

British consumer spending ticked up last month at a rate that greatly lagged behind inflation, according to surveys on Tuesday that underscored the pressure on household budgets ahead of the Christmas holidays.

Barclaycard said spending on its credit and debit cards rose 3.9% year-on-year in November, far behind the annual 11.1% increase in consumer prices in October that was the highest reading in 41 years.

Some 94% of Britons surveyed by Barclaycard said they were concerned about the impact of soaring household energy bills on their personal finances.