Loss Prevention Research Council Weekly Series - Episode 117 - Mid-Year Retail Checkup, E-Commerce, and UK Oxford Street

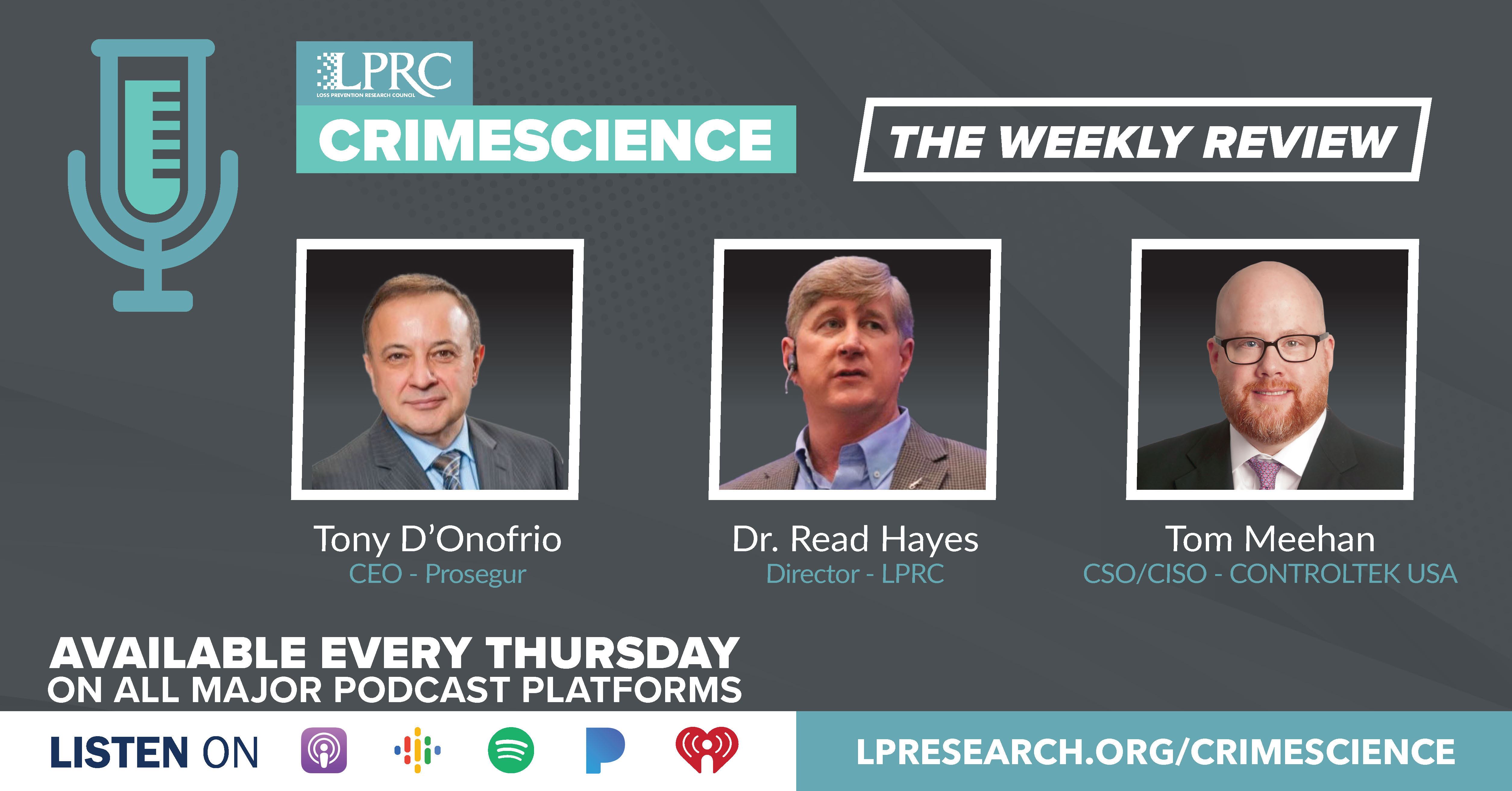

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Mid-year Checkup: What Retail Execs are Saying about inflation and inventory and more

https://www.retaildive.com/news/retail-executives-second-quarter-inflation-inventory-supply-chain-walmart-target/630235/

Let me start this week with some analysis from Retail Dive on what happened in the second quarter for retail in the USA, especially in topics such as inflation and inventory.

As Retail Dive said, the second quarter was rough for retail.

While there are potential signs of growth and consumer recovery on the horizon, retailers are still grappling with operational hits that are reverberating from the ongoing pandemic. That is happening alongside a consumer base that is dealing with inflation by changing its shopping behaviors. Meanwhile, many retailers are cutting guidance as demand for nonessential goods erodes in some categories.

This quarter, Target saw operating income fall 87% year over year, as gross margins dropped on markdowns and increased costs from merchandise, shrink and frieght. The company said it would be taking markdowns and canceling orders — a short-term pain in order to prepare for the last part of the year.

While Walmart performed better than anticipated in Q2, operating income in its U.S. business fell 6.7% due to lower operating profits and margins on markdowns.

Here are some quotes on inventory for the quarter in terms of inventory from retailers.

From the CEO of Walmart quote, “Starting back in March, we knew we needed to act quickly and aggressively in some categories and we have. We have made good progress to reduce inventory levels where we focused and taken markdowns. The aggressive approach we took to move through apparel in particular put financial pressure on us, but it helped relieve pressure on our stores and through our supply chain.”

From the CEO of Target, “Consider the alternative, we could have held on to excess inventory and attempted to deal with it slowly over multiple quarters or even years. While that might have reduced the near-term financial impact, it would have held back our business over time. Of course, this decision would have driven incremental costs to store and manage the excess inventory over a longer period. But much more importantly, it would have degraded the guest experience. It would have cluttered our sales force and hampered our ability to present new, fresh and fashionable items, the ones our guests expect from Target.”

From the executive vice president of merchandising for Home Depot, quote, “We are still having to pull inventory forward. If you think about today’s supply chain environment, our focus is to be there for our customers, to be there for our pros in terms of the right job lock quantities and the right timing of events and other activities. So part of our inventory overage is obviously due to that work in terms of being there for our customers.

We do have some carryover inventory from the spring season, but it is really low-risk inventory that we’re managing through and ensuring that we’re ready for next season. But overall, we feel very good about our in-stock position. We’re managing the inflation of our environment in inventory and will be there for our customers in terms of in-stock.”

From the CEO of TJ Maxx, quote “We are in a terrific inventory position, and we have plenty of open-to-buy to take advantage of the current environment. This allows us to offer even more exciting merchandise and value to our shoppers, which is our top priority every day.”

When it comes to inflation here is what retailers are saying about Q2 and beyond.

From the COO of Target, quote “While pressure from excess inventory has presented the biggest challenge to our team this year, dealing with high costs and volatility in the external supply chain has run a close second.

And today while conditions remain far from what we would have considered normal in the years before the pandemic, there are early signs that both costs and volatility may have peaked.”

From the CFO of Macys quote, “When you think about freight and delivery, fuel costs are currently trending down, but they remain elevated to what we saw earlier in the year.”

Interesting perspectives from the retailers and it will be interesting to see what happens if we do indeed enter a recession in 2023.

E-commerce Revenue to Shrink for the First Time

https://www.statista.com/chart/27982/e-commerce-revenue-and-forecasts/

From Statista, interesting news that global e-commerce revenue growth is shrinking for the first time. In what would be the first time ever, e-commerce revenues are forecast to shrink y-o-y in 2022.

As quoted in their analysis, 'From frenzy to fall: is eCommerce back to normal?': "This always has to be seen in perspective, and many industry experts contest the comparison of today's growth figures with pre-Covid-19 data. Nevertheless, the market is now compelled to tackle substantial questions about how to go forward. Even if there is a lot of headwind at the moment, we still believe online shares will eventually increase and revenue growth will get back on track."

Still, the expected negative growth is to be taken in the context of the previous forecast for 2022, which projected $481 billion more revenue by the end of the year. Supply chain issues is the largest single weakening factor, with inflation also playing a significant part in the downwards revision. The widely expected global recession and subsequent increases in unemployment leave the e-commerce sector significant hurdles to overcome before it can finally get back on track.

Oxford Street Footfall jumps 24% thanks to international visitors

https://www.retailgazette.co.uk/blog/2022/08/oxford-street-international/

Finally, as I am sitting in Europe this week, some good news from the retail gazette.co.uk website which reported that Oxford Street retail traffic jumped 24% thanks to international visitors.

A combination of factors will have contributed to the positive footfall levels in July, including heatwaves and the start of school summer holidays.

Major events are also likely to have drawn international visitors to the UK, including the Women’s Euros, with the finals being hosted at London’s Wembley Stadium.

Oxford Street is one my favorite place in the world to see retail trends and it’s great to see that the pandemic is more behind us and retail continues to come on strong.

And with that let me turn it over to Tom.